Apr

2020

Technology stocks’ financial strength is key to weathering the coronavirus storm

DIY Investor

2 April 2020

Alison Porter, Graeme Clark and Richard Clode from Janus Henderson’s Global Technology Team explain why the tech sector looks well positioned to brave the coronavirus-induced uncertainty and highlight how as active managers they are maintaining a laser-like focus on companies’ financial strength.

Key takeaways:

- Amid ongoing market volatility the team continues to focus on high quality technology companies with strong cashflows and balance sheets

- In prior crises the strength of technology company balance sheets has been a key driver of the sector’s outperformance versus broader equities.

- Major tech companies are helping to mobilise nations in the fight against the virus and enabling life to go on, which could potentially lead to a more balanced debate around future technology regulation

We live in extraordinary times. Sadly COVID-9 has reached global critical mass and the West has proved less able to contain its spread in contrast to the East (eg. China, South Korea and Singapore) resulting in a pandemic and national lockdowns.

The near-term economic impact of these lockdowns will be unprecedented; we are already seeing this in the travel industry but eventually every industry will be affected. An oil war between Saudi Arabia and Russia only exacerbates the economic stress.

The resulting demand shock really has no parallel in recent times.

The nationwide lockdown in China gave us some insight into the severity of the collapse in demand but in hindsight, the Chinese example is extraordinary in its brevity compared to their Western counterparts, being counted in weeks rather than months.

‘the fastest global falling market in history’

A longer, equally severe demand shock in the Western world threatens the survival of many companies, notably smaller businesses. With large job losses on the horizon, central banks and governments have matched the accelerated pace of the stock market in reacting to this threat.

That has all led to the fastest global falling market in history and a fast forward to a full Global Financial Crisis (GFC)-scale stimulus response in barely a month.

Pandemics by their very nature have tended to be finite in their duration and we think it is reasonable to expect that the virus can ultimately be successfully contained; people will return to work, schools will reopen and the world we live in as well as the global economy will return to some semblance of normality.

Source: Getty Images

Reassessing financial strength

However, in the interim, as active managers we need to assess the near-term impact on the fundamentals of the companies we invest in and stress test the balance sheets and cashflow assumptions of our investments to ensure they can survive through the next three to six months without any permanent or structural damage to their long-term investment prospects.

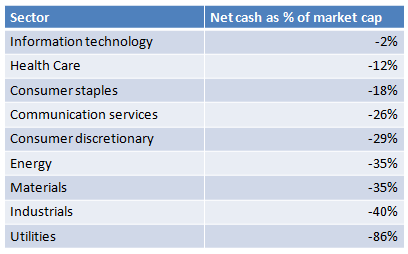

‘technology company balance sheets have been the strongest compared to other sectors’

Luckily in the technology sector, as we have highlighted for many years now going back to the GFC, technology company balance sheets have been the strongest compared to other sectors.

The largest (mega cap) technology stocks in particular have some of the biggest net cash balances. In prior crises the strength of technology company balance sheets has been a key driver of the sector’s outperformance versus broader equities. President Trump has already highlighted the moral hazard of bailing out companies that have for years funded share buybacks via borrowing, leaving these companies in a weakened position to weather the current economic storm.

Cash rich tech stocks

Source: Credit Suisse, as at 11 March 2020.

Note: Data shown is for MSCI World sector indices excluding the Financials sector.

Net cash: total cash on the balance sheet minus debt. Net cash as % of market cap: net cash as a percentage of the value of the company’s shares (market capitalisation).

Many technology companies have also carried out significant share buybacks in recent years but crucially these have in the main been funded via cashflow rather than debt.

The stock market is rapidly sifting through corporates to determine who will be vulnerable to this liquidity crunch. Our investment process continues to focus on high quality technology companies with strong cashflows and balance sheets.

The role of active management

Markets are not perfect and in these extreme conditions we can see dislocations in stock valuations versus company fundamentals, especially with algorithms dominating market trading ̶ screening quantitatively and selling down dispassionately.

Any company with high debt levels are likely to be punished even if their debt maturities are many years away and their business is relatively resilient.

‘see through the headline numbers and assess the true risk profile of a company’

Active managers can use their experience and deep knowledge of their investments and markets to see through the headline numbers and assess the true risk profile of a company.

Companies themselves can help by being pragmatic in terms of liquidity and communicating with investors. A good example was the Uber update call last week (19 March) where the company clearly communicated the strength of their balance sheet and liquidity in various draconian scenarios of prolonged recession, which led to a dramatic rebound in the share price.

We have developed strong relationships with the management teams of our holdings over the years. Pro-active engagement on environmental, social and governance (ESG) issues, helps to foster an ongoing dialogue, which has proved invaluable in these challenging times, allowing us to offer advice in terms of the best way to communicate to investors and reassure the market.

Keeping an eye on signs of recovery

Uber also provided something less tangible but very important as we battle this crisis ̶ hope.

Hong Kong was one of their first markets to be impacted by the virus but it is also one of the first to recover; Uber has already seen a good recovery in their business from the nadir as people start to return to work there.

‘one of their first markets to be impacted by the virus but it is also one of the first to recover’

That mirrors the general recovery trend we are beginning to see in China as the lockdown ends and the economy begins to normalise.

Different sectors are recovering at varying speeds and although we are still generally well below pre-virus levels, there are areas such as smartphones that have almost returned to normal levels.

While still a long way off in the West, that recovery will come and the markets will anticipate that. In the meantime, we are ready to take advantage of investment opportunities while ensuring the majority of our portfolios invest in high quality technology companies with strong balance sheets.

Tech companies are supporting the fight against the virus

Ironically, given the recent regulatory scrutiny of ‘big tech’, it is these very companies that have come to the fore over the past couple of months to help mobilise nations to fight this virus and enable life to go on.

We are all now utilising remote working tools, online grocery delivery and online communication as we adhere to social distancing directives.

This pandemic has been so disruptive to our lives but imagine how much more disorderly it would have been without companies such as Amazon, Microsoft, Google and Facebook. Consequently, governments may start to acknowledge the benefits that these technology companies can offer, which could potentially lead to a more balanced debate around future technology regulation.

Hope springs eternal.

Glossary:

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Share buyback: the repurchase of shares by a company, thereby reducing the number of shares outstanding. This gives existing shareholders a larger percentage ownership of the company. It typically signals the company’s optimism about the future and a possible undervaluation of the company’s equity.

Net cash: refers to total cash on the balance sheet minus debt.

Liquidity:the ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Henderson Partner Page » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.