Apr

2022

Surviving the stress test: JP Morgan American

DIY Investor

30 April 2022

JPMorgan American has delivered the goods during a wild couple of years…..

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by JPMorgan American. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Anyone who has had the pleasure of working in a UK bank will probably be aware of the stress tests they need to undertake every year or so. These are designed to mimic volatility in the economy and see how well a bank would respond. Thrilling though they may not be, they’re arguably a useful way of understanding how much market volatility a bank is capable of coping with.

Anyone who has had the pleasure of working in a UK bank will probably be aware of the stress tests they need to undertake every year or so. These are designed to mimic volatility in the economy and see how well a bank would respond. Thrilling though they may not be, they’re arguably a useful way of understanding how much market volatility a bank is capable of coping with.

Investors tend to not have this luxury. Fund managers may stress test their portfolios internally but investment trust shareholders will most likely have to run their own models to see what the potential outcomes of any volatile periods might be. The other alternative is to sit back, wait for some real life ‘stress tests’ to arrive, and then see what happens.

Anyone who was looking to do this will have had a wonderful couple of years. Since the Covid-19 pandemic began in 2020, the markets have felt like one, long, real life stress test.

When the pandemic started there was a massive market crash and then a rush into growth stocks, as people looked for businesses more likely to remain immune from the various restrictions imposed on people across the world to contain the virus.

That was followed at the start of 2021 by the so-called ‘reopening trade’, where cash flowed into value stocks, as investors tried to take advantage of companies that looked more likely to benefit from vaccine rollouts and any subsequent return to normality.

There was then another rotation into growth, as companies like Amazon and Alphabet continued to produce strong earnings growth. Finally, the end of last year and the start of 2022 has seen another flip back into value, as investors try to shield themselves from inflation and find safe havens for their money during a period of political instability.

Still interesting

Two years is not the ideal timeframe in which to judge a fund manager’s performance. It’s usually too short a period to tell whether any positive results were simply fortuitous, or if a stint of underperformance was actually out of the manager’s hands.

But the past couple of years have been so volatile that, even if we can’t draw any firm conclusions from performance, it’s still been very interesting to see how portfolios have performed.

For instance, if you look at trusts that have a focus on the technology sector, their share prices have tended to ebb and flow in line with the movements between styles described above. The year to date, for example, has not been positive for them because of the move to value.

It’s a rather different story with JPMorgan American Investment Trust (JAM). Like most of the market, the £1.5bn trust was hit hard by the Covid-induced crash that took place in early 2020. But since then it has performed well and avoided some of the dips and dives suffered by other closed-ended funds over the course of the pandemic.

The best of both worlds

The reason for that is due to the way in which the trust’s portfolio is constructed. Timothy Parton and Jonathan Simon, who have co-managed JAM for close to three years now, each take a different approach to the market.

Parton invests in growth stocks, meaning companies like Apple and Amazon continue to feature among the trust’s largest holdings. Another big chunk of the portfolio is made up of Simon’s value picks. That’s why firms like Capital One and Loews sit in the top 10 holdings at the time of writing, alongside some of those better-known growth names.

Eytan Shapiro also contributes to the portfolio with a selection of small caps, but this is capped at 10% of the overall portfolio and has only averaged about 5% over the past 12 months. That means the bulk of the trust’s holdings are split between the value and growth picks that Parton and Simon make. There is a 60% limit on either style in the portfolio and it’s normal for there to be some level of fluctuation in which one is more predominant.

Taking this approach has enabled the trust to withstand many of the ups and downs that we’ve seen during the pandemic. Whereas others with similar holdings, particularly on the growth side of the portfolio, have seen some extreme volatility, JAM has remained much more stable over the same period.

Delivering the goods

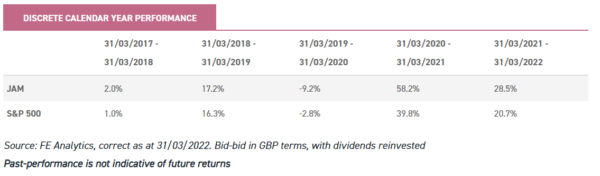

It’s also managed to deliver strong returns to shareholders. Since taking the reins in June 2019, Parton and Simon have outperformed the S&P 500 by almost 15%. This is extremely impressive for a market that’s notoriously hard to find alpha in, and a real positive for the managers as they approach the three year mark in managing the trust.

It’s a performance that’s also in keeping with the trust’s longer-term track record, which has seen it ride out several market cycles and outperform the US benchmark index over the past 10 years and 20 years.

Obviously, many investors will be pleased just to see the bottom line. But delivering those returns with value exposure, particularly in the past decade, was especially impressive given how well growth – the opposite style – performed in that time.

And looking back at the trust’s performance over the past two years arguably shows that its approach enables it to navigate different trends in the market more effectively than others. The trust performed well relative to its peers, regardless of which style was seeing another manic resurgence in popularity. And it did so without many of the crazy dips and dives in share price that we’ve seen elsewhere.

As noted, the past two years of Covid-induced volatility is not the ideal timeframe in which to judge a fund. Nor are stress tests likely to replicate exactly what will happen in the future. But over a period of extreme and rarely precedented macroeconomic volatility, JAM has delivered a creditable performance. And that’s ultimately something any investor should find hard to ignore.

View the latest research note here >

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.