Jan

2022

Slow start to the year for most funds

DIY Investor

20 January 2022

After a brief rally at the end of last year, most stock markets around the world have had a lacklustre start to 2022.

Although it has not caused as many fatalities as was initially feared, the Omicron variant of the Covid-19 coronavirus has spread much quicker than previous strains. Infection rates are high and that is forcing people to take time off work, which is affecting productivity. Social distancing regulations have also been reintroduced in some countries.

At the same time, governments and central banks are trying to reduce the amount of stimulus they are providing to keep economies afloat. They are concerned by the record levels of inflation. In November, the UK inflation rate for the previous 12 months was 5.1%, its highest figure for a decade. It is even worse in the US, their annual inflation figure for December was 7%. It is almost 40 years since they have seen rates that high.

To try to bring inflation back down, the Bank of England has already increased interest rates for the first time in eight years. In the US, the Federal Reserve has reduced its monthly bond purchases and will continue to do so. It expects to increase interest rates a couple of times this year and the first could be in March. The ready availability of cheap money has pushed up stock prices. Therefore, any tightening of monetary policy will cause uncertainty in the markets. The Nasdaq fell by more than 3% when the minutes of the Federal Reserve’s latest meeting were released on 5 January.

In the first week of this year, the Dow Jones Industrial Average fell by 0.3%, the S&P 500 lost 1.9% and the Nasdaq was down 4.5%. The Shanghai Composite and the Nikkei 225 also made losses. These represent the stock markets of the three largest economies in the world, the US, China, and Japan. The UK’s FTSE 100 bucked the trend, gaining 1.4%, but the FTSE 250 also went down, losing 0.5%. There were further losses last week.

Each week we review the performance of thousands of funds. The first thing we do is sort them into their Investment Association (IA) sectors so that we can calculate sector returns. We then put the sectors into our Saltydog groups based on their historic volatility.

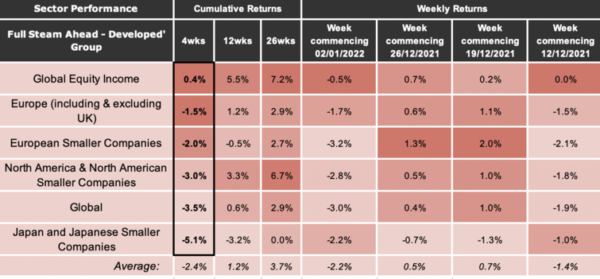

Here is a table showing the performance of the sectors in our ‘Full Steam Ahead – Developed’ Group, up until 8 January.

You can see that all of the sectors went down during the week commencing 2 January, and most of them are also showing cumulative four-week losses. It was a similar story for the other groups.

The only sector that went up that week was UK Equity Income, which made 0.6%. The Technology and Technology Innovations sector had the biggest one-week loss, falling by 5.1%.

We are about to start crunching last week’s numbers and I am not expecting them to be any better.

Our demonstration portfolios have also gone down, but at least they were holding relatively large amounts of cash. This will have softened the blow. Our Tugboat portfolio currently has 57% in cash and in the Ocean Liner it is 46%.

One of the advantages of investing in open-ended funds is that they do not usually have an initial charge or a bid/offer spread, and you do not pay stamp duty when you buy them. This means that in times of uncertainty there is not a significant financial penalty for ‘going safe’ and protecting your capital. You can always reinvest when conditions improve and at least you will live to see another day.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.