Jan

2020

Rule Britannia or Fool Britannia?

DIY Investor

4 January 2020

It feels like I’ve been writing US-China trade wars and Brexit in investment commentaries since the Flood. Potential new investors have been spectating for months, waiting for resolution of these issues, particularly given 2018’s annus horribilis where cash was king (if a less-than-generous one).

Those enthralled by Donald Trump’s Twitter diplomacy may not have noticed that US and UK equity markets were up 24% and 14% respectively for the year to September 2019 — not a paltry return considering we’re approaching the eleventh year of a bull market. Since March 2009, the S&P 500 has grown by 12% per annum in dollar terms, but a massive 16% per year in sterling terms.

Value for money

That said, the US S&P 500 is now at a valuation level (by Cyclically Adjusted PE ratio or CAPE) seen only twice before — just before the Great Depression and again before the dotcom collapse in 2000. In marked contrast, UK shares appear to offer reasonable value, with the CAPE ratio close to its long-term average and dividend yields well over 4% — half of those in the US, and a third higher than their long-term average of around 3%.

Boris Johnson’s announcement of a Brexit deal, followed by polling showing the Conservatives with a commanding lead over Labour as a General Election approaches, appears to have given birth to optimism among previously wary investors. The Q3 slowdown in UK equity outflows and bond inflows, may indicate a return in investor confidence. Consequently, a focus on UK Equity funds may be de rigueur over the coming months… let’s look at the three sectors that matter.

UK All Companies

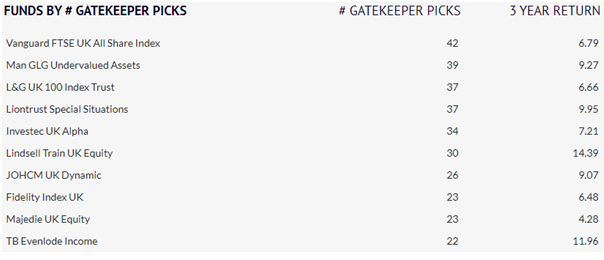

Among the favourites will certainly be Nick Train’s UK Equity fund and Vanguard’s All-Share tracker. Growth has outperformed yet again this year, but there are signs that value investors may get a bigger bang for their buck, since the All Share index bounced back in mid-August (click on image to see full rankings).

UK Equity Income

Equity income funds have been rather less in favour with fund selectors who have eschewed higher-yielding funds over the past couple of years. Man GLG UK Income remains the fund selector’s favourite in this sector with 35 appearances but rather lacklustre performance relative to its peers may cause selectors to begin to look elsewhere. The recent outperformance (+18% in 2019 as I write) of £1.5bn Marlborough Multi-Cap Income, a perennial list member since its launch, may encourage a reappraisal of its potential (click on image to see full rankings).

Smaller companies have had a hard time of it during 2019, but a Conservative working majority after the election could provide a significant boost to their fortunes. Cavendish AIM fund has returned over 26% over the first three quarters of the year, but it’s featured on few lists.

Liontrust Smaller COs, on the other hand, has 32 selections, and despite returning virtually half the gains that Cavendish produced, has exceeded both the sector average and the FTSE All-Share index.

Higher weightings towards UK Equity at the expense of Cash and US Equity may be on the cards in the run up to the election and afterwards. But there is a lot of polling to be done before then…

Established in October 2010, Fundscape is a research house specialising in the end-to-end research and analysis of the UK fund industry. It is the publisher of the quarterly Fundscape Platform Report, widely regarded as the industry benchmark for platform data and statistics in the UK. With many years’ industry experience, its team is well placed to provide unique insight into asset management and distribution trends, including product development, distribution and marketing. Visit Fundscape.

Find out more about Selftrade Log in to my account

To learn more about actively managed funds read the latest issue of Focus on Funds magazine:

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.