Dec

2021

Outlook 2022: UK equities

DIY Investor

17 December 2021

Sue Noffke and Andy Brough explain how they’re looking at the UK stock market heading into 2022.

Sue Noffke and Andy Brough explain how they’re looking at the UK stock market heading into 2022.

- The UK holds many mispriced opportunities for stockpickers.

- Pick-up in M&A activity is striking.

- Stock market fit for the future.

Sue Noffke, Head of UK Equities:

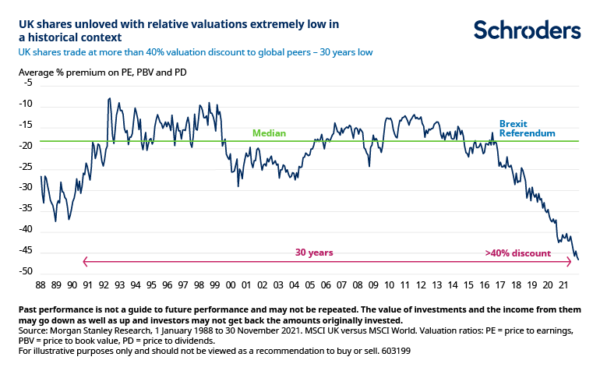

UK shares remain cheap because of the perceived significant political and economic risks of Brexit, which continue to linger and depress the valuation of the UK stock market. We believe the extent of the valuation discount is completely unwarranted. The ratings of all variety of UK-listed companies are being negatively impacted.

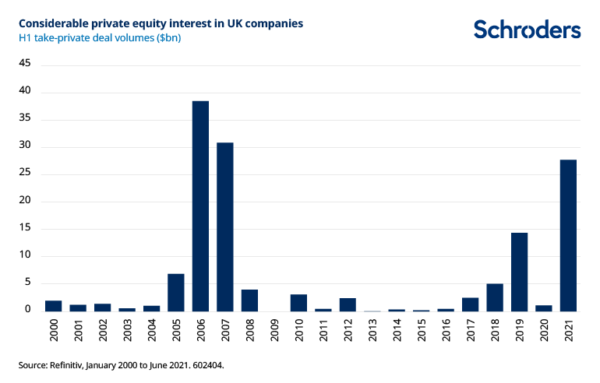

As a result UK-listed companies continue to be picked off by overseas private equity (PE) buyers and overseas industry peers are taking advantage of valuation differentials in a wave of merger and acquisition (M&A) activity. In the first half of 2021, PE buyers were the most active since prior to the Global Financial Crisis (GFC).

Somebody’s buying UK shares, it’s just not stock market investors at present.

Multiple catalysts converge?

What could change this situation and prompt a broader reappraisal? Well, we see a number of potential catalysts coming together. One of them could be those activist investors who, it seems, are being drawn in ever-greater numbers to lowly valued FTSE 100 companies.

Many of the targets had already set out sensible and detailed improvement strategies long before this new-found attention. They include mega caps GlaxoSmithKline, with its well-telegraphed plan to spin off the consumer healthcare business, and Shell, whose transition to renewable energy has been much consulted on, and very recently accelerated.

At risk of ceding control to activists (some of whose proposals appear of quite a short-term nature) boards may be catalysed to deliver on existing plans with even more urgency.

It was interesting, for instance, to see FTSE 100 energy company SSE recently propose selling stakes in its electricity networks to invest more heavily in renewables. This was after the appearance on the share register of Elliott Investment Management, said to be in favour of breaking the business up.

In other cases, activist stakes are seen as the possible prelude for a bid. This is the widely held assumption for BT. BT has spent much time negotiating the regulatory pre-conditions necessary to roll out an ultra-fast fibre network in the UK at a reasonable rate of return.

These developments long predate a recently established 12% shareholding of telecoms investor Patrick Drahi.

An often heard complaint is that UK shares are cheap because they’re “old economy” businesses in the banking and oil sectors, rather than technology companies.

However, even after adjusting for these weighty sectors the UK still appears very unloved. And we can point to many good quality UK-listed companies where a like-for-like analysis with global peers reveals marked valuation discounts.

Fund outflows offer a better explanation of this situation. The uncertainty resulting from Brexit (and the associated political upheaval) has made global asset allocators very wary of UK assets, including UK-listed shares.

From the perspective of these large international investors the country has been best avoided. Brexit was the trigger for a sustained fall in the value of sterling and the fact UK assets have performed very poorly for a long time in dollar terms has helped keep them away.

Encouragingly, however, as political and economic risks of Brexit have receded and the UK led with the roll-out of Covid-19 vaccinations the uncertainty has receded. It may, however, take a bit longer than a few months to change perceptions.

Fit for the future

Lord Hill’s review of UK listing rules could be an important milestone in challenging some very entrenched views about the UK stock market. Any resulting reforms could help better highlight the positives.

There are many UK businesses fit for the future, whether that is around the energy transition, cyber security, growth in gaming and online retailing, fintech or life sciences. In the case of the latter a powerful public/private co-operation has delivered some great UK success stories, the most recent example perhaps being DNA sequencing specialist Oxford Nanopore Technologies.

There are many new sectors where the UK excels, it’s just some of the opportunities are not as visible as they could be due to the current listing rules.

At the same time, there is also scope for some of the old economy businesses to reinvent themselves. With regards to Shell and BP, we believe they can be part of the solution amid urgent efforts to reduce greenhouse gas emissions to head off unchecked global warming.

Meanwhile, Drax, once the UK’s largest operator of coal-fired power stations, last year generated the large majority of its power from renewables. It will soon be completely renewable and has an ambition to be “carbon negative” by 2030 using technologies such as carbon capture and storage.

If achieved, this ambition would see the group remove more carbon from the atmosphere than it produces throughout its direct business operations. If Drax can be a leader with carbon capture and storage in the UK, then it has the potential to be a leader on the global stage too.

We see many other UK-listed companies with great global potential and expect it will be only a matter of time before this is recognised by the wider market.

Wider uncertainties

The wider market, however, does face a number of uncertainties as we head into 2022. Uncertainties around the potential implications of regulatory reforms in China are likely to remain in focus, for instance.

Investors are also increasingly contemplating a global shift for interest rates away from emergency settings as central banks reduce the significant stimulus they are providing for economies.

In this context, we’ll need to see what decision makers at the US Federal Reserve in particular view as an acceptable level of inflation, and what exactly they deem to be a “transitory” period of time.

Luckily, there are companies whose business models will potentially benefit from rising inflation. These could include recipients of infrastructure related spend such as diversified miner Anglo American, BT with fibre networks and US building products distributor Ferguson.

Meanwhile, if higher inflation is seen by policymakers as a worthwhile trade-off for higher employment, employment agencies could be a sweet spot. Especially so given Covid-related challenges facing labour markets in many developed economics, including the UK. The economic backdrop seems quite different to the sluggish one seen in the wake of the GFC.

Other companies are well-placed to weather inflation such those in the financials sector. And, following a very strong rebound from Covid, many of the strongest businesses have surplus cash to grow their operations and reward shareholders.

Dividends are on track for a much better-than-expected recovery in 2021. How payments progress into 2022 will be down to a variety of factors, but the long-term outlook is encouraging.

Companies are in a good position to deploy their excess cash in any number of ways, including investing in their businesses, making acquisitions, paying down debt, buying back shares or distributing more to investors via dividends.

Andy Brough, Head of Pan-European Small and Mid Cap Team:

The FTSE 250 index is known for being the most dynamic segment of the UK stock market. And it is living up to this reputation again, with a good pipeline of initial public offerings (IPOs) providing plenty of candidates to fill gaps resulting from an exceptionally busy period for M&A.

Out go exciting growth companies like online bingo and casino gaming group Gamesys (acquired by US peer Bally) and gaming software group Playtech (subject of a three-way bidding war between Australian slot machine manufacturer Aristocrat, shareholder Gopher Investments and JKO Play). To fill the gaps, in come businesses such as consumer review website operator Trustpilot, or Petershill Partners, an owner of minority stakes in alternative asset managers.

Mid cap companies such as Petershill or IP Group are benefiting from the structural growth trends driving the private equity (PE) market. IP, for instance, has recently realised significant value from the IPO of investee and DNA sequencing specialist Oxford Nanopore Technologies.

Opportunity to buy prized assets

But the PE market is not only providing some good opportunities for investors mid-cap companies, it is giving us some important signals.

Mid cap companies are at the centre of the M&A interest in UK-listed companies from overseas peers and PE or PE-backed purchasers. It’s always helpful to observe what the corporate and PE sectors are doing since we share their long-term mentality.

If the pick-up in inbound M&A activity is a guide, it seems to us these bidders are currently thinking: “UK shares are cheap, sterling is weak, this is our opportunity to buy some prized assets outright.”

We’ve seen these buyers take advantage of unwarranted discounts in sectors such as gaming, where like-for-like growth prospects are very similar versus international peers.

For example, around a year ago it was possible to buy Gamesys for around £10, equivalent to a price-to-earnings, or P/E multiple, of around 10 times. This valuation failed to adequately reflect the company’s good long-term growth prospects.

Subsequently, Bally made its bid at £18.50 a share, taking advantage of the clear arbitrage opportunity.

Lord Hill’s review of UK-listing rules could be an important catalyst to encourage investors at large to look again at the UK stock market.

Due to their dual-class share structures, online food delivery specialist Deliveroo and money transfer service Wise, to take two examples, currently only have access to a “standard” as opposed to a “premium” listing.

As a result they miss out on possible entry to the FTSE’s series of indices, of which the FTSE 250 is the next most established index outside the FTSE 100. Companies excluded from these indices are less visible, since exclusion puts them off the radar of many investors.

Should the Hill reforms resolve the dual-class share structure issue, Deliveroo, Wise and potentially other similarly new public companies will have a chance to qualify for index inclusion.

Suddenly the visibility of these opportunities improves, helping dispel the myth the UK is dominated by “old economy” companies, which is simply an outdated argument now.

True pricing power

Should concerns around inflationary pressures persist in 2022 then companies with true pricing power might come into their own.

Inflation in the energy market may prove more sticky than expected, which could affect some consumers more than others. The importance of stock picking in this environment cannot therefore be overestimated.

Companies with niche products exposed to structurally growing markets will also be better able to pass on rising costs to the consumers of their products. Good examples here might include games and crafting company Games Workshop or international veterinary products business Dechra Pharmaceuticals, which is enjoying very strong growth in its core companion animal market.

Glossary of terms:

Price-to-book value (PBV) ratio

A company’s “book value” is the value of its assets minus its liabilities (net asset value), at a set point in time. If a company’s share price is lower than its net asset value (PBV ratio of less than one) then it might be considered as potentially good value and worthy of further analysis. However, for companies with little in the way of physical assets, such as technology companies, PBV ratios have their limitations.

Price-to-earnings (P/E) and price-to-dividends (PD) ratios

The P/E ratio compares a company’s share price to its earnings per share. The PD ratio is a company’s dividend per share divided into its share price. Because a PD ratio accounts for cash actually being paid out to investors (dividends) as opposed to earnings, which are an accounting concept, it can be a more reliable valuation metric.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Brokers Latest » Commentary » Equities » Equities Commentary » Equities Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.