Feb

2020

Investing in emerging markets in a maturing global cycle

DIY Investor

13 February 2020

Many emerging markets investors may be wary of the relatively sluggish global economy and signs of a maturing global cycle. However, Austin Forey, lead portfolio manager for the JPMorgan Emerging Markets Investment Trust, views any signs of a potential slowdown as a natural part of long-term investing.

It’s certainly true that low commodity prices and a strong dollar have been a challenge for emerging markets for some time, meanwhile in recent months uncertainty about the ongoing global geopolitical situation has caused heightened levels of volatility for many emerging market equities.

Potential rewards from investing in emerging markets

However, it’s important to realise that the broad picture fails to reflect the vastness and complexity of emerging markets as an asset class.

For investors with a long-term outlook and access to the right expertise, the potential rewards from investing in the right emerging market companies is significant.

‘For investors with a long-term outlook and access to the right expertise, the potential rewards from investing in the right emerging market companies is significant.’

In the past five years the JPMorgan Emerging Markets Investment Trust has returned 93.5%, materially outperforming the benchmark of 58.4%. So, whatever the global economy has in store, I remain confident in the potential of our emerging market investments to perform over the long term.

The trust has been in existence since 1991, and while past evidence should never be treated as an accurate predictor of future performance, it does provide a certain degree of perspective.

Having been at the helm for over 25 years, I’ve seen the trust grow through multiple market cycles and can point to the muted impact both of the 1997 Asian crisis and of the 2008 global financial crisis on its overall performance.

Long-term growth through sustainable companies

However, far more importantly, our investment philosophy is focused on long-term growth, and that we achieve this through a portfolio of companies which are sustainable in the broadest sense of the word.

At a quantitative level we’re interested in return on equity as a proxy for the calibre of a business. Levels of debt are also a key indicator.

However, underlying strong economic performance there must be a robust business model: the ‘G’ for governance in ESG (Environmental, Social and Governance) is fundamental.

How is a company run and financed? Is it in charge of its own destiny? How does it position itself against competitors? What is the longer-term strategy and are the resources in place to make it happen?

The benefits of experience and scale in the local markets

Getting under the skin of a business to gain a true understanding of the culture and philosophy underlying the facts and figures is central to our approach.

Fortunately the scale, diversity, local expertise and global reach of our 37-strong research team means we can claim a depth of understanding few competitors can rival.

It allows us to have strong conviction in the holdings in our portfolio, because we have confidence that they have the resilience to thrive in adversity.

In fact, for well-run companies in control of their own destiny, the healthy market weakness represented by a flattening of the market cycle provides a potential opportunity, because less well-run competitors will inevitably struggle.

What’s more, as investors equipped with clear information on our target holdings’ fundamentals, we see the short-term impact of choppier markets on the valuations of even the strongest stocks as an opportunity to buy at attractive prices.

So, while I don’t claim to be able to predict what the global economy has in store for emerging markets as an asset class, I can say with confidence that our process for selecting stocks works, putting the trust in a strong position whatever the future holds.

Important Information

JPMorgan Emerging Markets Investment Trust plc

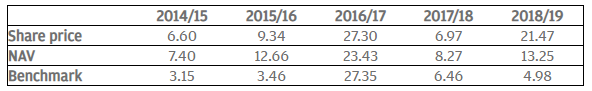

Quarterly rolling 12 months – as at end of June 2019 (%)

Past performance is not a guide to current and future performance. Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

Key risks

Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations. Where permitted, a Company may invest in other investment funds that utilise gearing (borrowing) which will exaggerate market movements both up and down. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The Company may invest in China A-Shares through the Shanghai-Hong Kong Stock Connect program which is subject to regulatory change, quota limitations and also operational constraints which may result in increased counterparty risk.

Past performance is not a guide to current and future performance. Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Investor Disclosure Document, Key Features and Terms and Conditions and Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. Material ID: 0903c02a826f77df

Leave a Reply

You must be logged in to post a comment.