Dec

2021

Grounds for optimism in Europe in 2022

DIY Investor

27 December 2021

Sam Morse, portfolio manager of the Fidelity European Trust PLC, assesses the outlook for the region’s equity markets. With the pick-up in economic activity leading to strong corporate earnings, he believes Europe offers an increasingly positive backdrop for investors in 2022.

My outlook for Continental European equities grows increasingly optimistic as we approach 2022. While predictions are, as ever, very difficult to make, we are increasingly confident that the worst of the pandemic has indeed passed. Vaccination rates in the developed world continue to improve and we are encouraged to see more treatments become available for those unwell with Covid-19. This improves the prospect of a sustainable reopening of economies and we therefore feel more constructive because the fundamental obstacle to economic progress is slowly being dismantled.

As the outlook improves, Europe is particularly exposed to a pick-up in global economic activity, given its strong export sector. This in turn is leading to good growth in corporate earnings. We have already seen a strong rebound in corporate earnings, while monetary policymakers have continued to signal their support. Inflation poses some risk, but the ECB has pledged to keep interest rates at historic low levels unless we see inflation persist “durably” above the bank’s 2% target. This is providing a positive backdrop for equity investors as we look ahead to 2022.

What could surprise markets in 2022?

If the Covid-19 pandemic has taught us anything, it is that we should always expect the unexpected. When predicting the outlook for 2020, how many portfolio managers predicted a global pandemic?

That is why we prefer to reflect on the wisdom of Fidelity’s Peter Lynch who opined “nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.” This is precisely what we will continue to do as it gives us the best foundation to respond to the unexpected.

Positioning for what lies ahead in 2022

Despite the chaos that Covid-19 has caused, 2021 has actually been a good year for continental European equities. We have seen a record number of European companies reporting positive earnings revisions.

A natural outcome of these positive trends is that there is now significant optimism priced in to share prices. Valuations in some areas do look stretched, particularly in more cyclically-exposed sectors that have enjoyed a strong rebound over the year. One potential risk is that any small misses by businesses could spook the market and spark a disproportionate decline in share prices. This, of course, highlights the importance of a focus on valuation and understanding the long-term drivers of a company.

We must also consider the well-documented pressures on supply chains and the inflationary pressures that this is placing on households and businesses. When we are looking at the quality of companies we hold, special attention will be paid to their ability to manage in such an environment and whether margins can be protected by passing cost increases onto customers. There are many excellent quality businesses in Europe that will find this a point of differentiation versus peers, which creates opportunity.

Stock market leadership will, as always, continue to rotate. Our investment process seeks to build a well-balanced portfolio across sectors, meaning that stock selection is the primary driver of risk and return.

That said, one of the greatest areas of risk today is in the valuations we are required to pay. Fundamentals should begin to play an increasingly important role once more in share price returns as the strong stylistic shifts we have experienced through the pandemic begin to fade. Here, Fidelity’s strength in fundamental research and our superb analyst team should prove a differentiator in finding opportunities that the market may have overlooked.

We are already seeing opportunities between and indeed within sectors. One area where we see many excellent businesses but find fewer attractively valued opportunities than we would like is industrials. We have added modestly to our exposure where valuations allow – such as in initiating a new position in automated locks and security business Assa Abloy. This is a name we have followed for some time and waited patiently for a period of weakness to initiate the position.

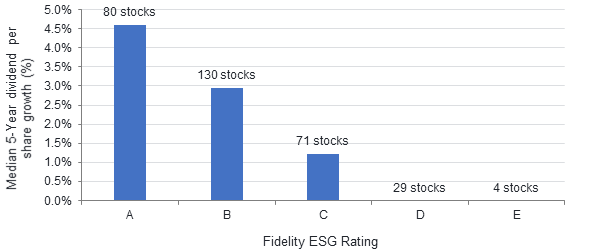

ESG vs dividend growth

Source: Fidelity International, 31 October 2021. Data representative of MSCI Europe ex-UK Index. Figures denote number of stocks rated within each bucket. Median 5-year DPS growth for D and E rated companies = 0%. The Fidelity Sustainability Ratings were launched in June 2019. As at 30 September 2021, they cover a universe of c. 4,200 issuers in equity and fixed income. Fidelity has a five scale rating of A (best) to E (worst). For illustrative purposes only.

Sustainability considerations

We expect sustainability to continue to play an ever-increasing role in influencing asset flows and share price returns. Europe as a region typically has high standards of governance when compared to other markets and, within this, the portfolio screens well – nearly 85% of the portfolio is rated A or higher by MSCI as at October 31, 2021.

Our focus on sustainability of dividends typically leads us to favour the types of companies that are highly rated on ESG and sustainability grounds. Companies that exhibit sustainable growth characteristics and pay attractively growing dividends tend to have good business practices. Indeed, the correlation between long-term dividend growth and ESG credentials is interesting as seen above.

Important Information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Investors should note that the views expressed may no longer be current and may have already been acted upon. Overseas investments are subject to currency fluctuations. Fidelity European Trust PLC can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

Commentary » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.