Feb

2022

Everything you should know about IPO in 2022

DIY Investor

26 February 2022

When you decide to buy stocks , there are many companies you can choose from – guest post from Jonathan Veers, Founder of SPV Mortgages.

When you decide to buy stocks , there are many companies you can choose from – guest post from Jonathan Veers, Founder of SPV Mortgages.

From small caps to multinationals, these companies have all gone through a process to raise capital and attract public investors. This is called an IPO or Initial Public Offering. Here are some useful tips from Spv mortgage company to find out how an IPO works and what precautions to take before participating in an IPO.

What is an IPO?

An IPO ( initial public offering ) is a financial operation in which a private company decides to list its shares on the stock exchange. The company can thus raise funds on the financial markets , from many institutional or private investors, to support its growth.

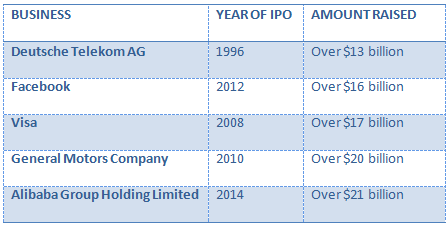

Here are some of the biggest IPOs to date:

Why do companies go public?

An IPO allows a company to obtain additional capital by issuing new shares to the public in order to finance its growth or repay its debts. And this will also make it easier for it to find financing in the future , either from banks or directly on the market.

An IPO also allows a company to make itself known , to strengthen its notoriety, its credibility and to benefit from important partnerships for its development.

Going public finally allows the first historical investors to sell their holdings , most often realizing a nice capital gain.

But an IPO does not only have advantages. In particular, this forces listed companies to comply with certain requirements in terms of transparency on its accounting and financial information.

How does an IPO work?

Getting into an IPO takes a lot of time and energy. This is why companies that want to make an IPO surround themselves with specialized partners to properly prepare their IPO and comply with regulatory requirements.

There are two main stages before pricing an IPO – a documentation stage and a marketing stage. Within this process, various sub-steps structure the operation.

The company must in particular:

1. Surround yourself with the right companies to form strategic partnerships: lawyers, investment banks, accountants, communication and marketing companies, etc.

2. Decide on the type of IPO : sale of capital, capital increase, etc.

3. Choose the market on which the company will be listed : Euronext, Nasdaq, etc.

4. Determine the best IPO procedure : direct listing, open price offer (OPO), open price offer (OPO), minimum price offer (OPM)…

5. Obtain the necessary authorizations depending on the marketplace where the IPO will take place : e.g. SEC in the United States, etc.

6. Communicate on its IPO to find investors : the company must use different means of communication to reach the right investors.

On the day of the IPO, the new shares are issued. The money from the investors who subscribed to the IPO – the capital from the primary issue – is received by the company which registers it in its equity.

However, certain subscribers may benefit from a specific period, after the IPO, to buy additional shares.

How to profit from an IPO?

To sign up for an IPO, you need to approach your bank or stockbroker , who will get you into the IPO. You will then become a shareholder of the company as soon as your shares are delivered to your ordinary securities account.

Participating in an IPO can be quite stressful. This is why many investors wait until the day the new shares are listed to participate in them via the secondary market.

Note: To keep informed of upcoming IPOs, you can consult the sites of major stock exchanges, such as Euronext and Nasdaq , or stock market regulators such as the SEC.

Should you participate in an IPO?

Before you participate in an IPO, you need to fully understand what is at stake. Find out if the asking price is exaggerated and beware of aggressive marketing campaigns.

Advantages of IPO

● Take advantage of a good deal as the first public investors.

● Make profits over the long term if the business grows as planned or faster.

● Receive dividends if the company has a profit redistribution policy.

● Use transparent financial communication once the company is public.

Disadvantages of IPO

● Poor valuation of an IPO.

● Fall in prices on the first day of trading and market volatility.

● Low liquidity and trading volume.

● Potentially high IPO participation fees.

What precautions should be taken before participating in an IPO?

● Take the time that is necessary to obtain all the information available on the company and also its IPO,

● Analyze the company’s reasons for wanting to go public and its growth prospects,

● Take into account the economic cycle , the sector in which the company operates, the drivers of growth, as well as the competitive landscape,

● Decide if the IPO matches your trader profile, your risk tolerance and your financial goals,

● Choose a reliable, reputable and serious intermediary to avoid scams,

● Determine if the proposed IPO price is reasonable. Beware of Marketing – Remember that it is in the interest of historical shareholders to list the company at the highest price!

IPO and Passive Management

When a large company goes public, it is likely to include a stock index . This was the case, for example, of Facebook which integrated the S&P 500 and the Nasdaq during its IPO.

Therefore, if you adopt passive management using ETFs (whose objective is precisely to replicate a stock market index) you participate in the IPOs of the largest companies, with some advantages:

● you do not directly bear the costs associated with the subscription;

● you maintain a diversified portfolio;

● you don’t have to do anything and don’t need to follow IPO news, it’s automatic!

Also be aware that there are also ETFs (exchange traded funds) dedicated only to IPOs and companies that have recently issued new shares.

Jonathan is Founder of SPV Mortgages. SPV Mortgages can help you find the best limited company mortgage options for your property investment.

For more information and a BTL tax calculator visit:

Brokers Commentary » Brokers Latest » Commentary » Equities » Equities Commentary » Equities Latest » Financial Education » Latest

Leave a Reply

You must be logged in to post a comment.