Mar

2020

Don’t panic: the case for investing in Asia this ISA season

DIY Investor

6 March 2020

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

The coronavirus outbreak in China has developed from a humanitarian catastrophe to a stock market panic.

While the short-term economic impact of the virus could well be severe, there are still fundamental reasons to be invested in developing Asia for long-term investors.

Historically one reason investors have been encouraged to invest in emerging Asian markets is to benefit from the region’s greater GDP growth.

‘there are still fundamental reasons to be invested in developing Asia for long-term investors’

The OECD forecasts that UK real GDP, that is adjusted for inflation, will grow by 2.2% a year between 2020 and 2060, and the USA by 1.9%, whereas China is projected to grow by 2.4% and India by as much as 4.5%.1

Thanks to the power of compounding, this increase amounts to growing 1.1 and 1.3 times larger in the case of the US and UK, 1.5 times in the case of China and 4.5 times in the case of India.

Economic theory posits that the long-run return from a stock market should be equal to the long-run growth in corporate earnings, which is determined by long-run GDP growth. On that basis China and India should see much greater stock market gains.

This theory has a poor record in practice, and it is now common knowledge that GDP growth and stock market returns are generally not correlated.

Indeed, it is possible that the correlation is weakening over time, given the propensity for companies to list in countries outside of their main areas of business.

‘We consider why you might add to your Asia exposure in your ISA this year’

This doesn’t mean that GDP growth potential in emerging markets is irrelevant, however.

We would argue that the underlying drivers of GDP growth are very relevant to the earnings potential in individual companies, which means that GDP growth can be valuable information for a stock-picking manager.

In fact, we would argue that understanding the reasons behind GDP growth gives a better comprehension of how to invest in developing countries – such as those in Asia – and the advantages they really have.

We consider why you might add to your Asia exposure in your ISA this year, despite the short-term issues, and look at some stock-picking trusts set up to generate alpha from the region’s advantages.

What drives stock market growth?

We believe there are three main reasons that stock market growth diverges significantly from GDP growth.

- Dilution. In theory, GDP growth brings growth in corporate earnings, which flows through to the share price. However, not all this earnings growth is enjoyed by existing shareholders, whose positions may be diluted by the effects of placings, IPOs and other capital injections. One way of illustrating this is to compare the growth in market capitalisation of the US stock market to the growth in the index price. The effects of dilution are estimated to have subtracted 2% a year from real GDP growth over the course of the twentieth century.2

- Valuation. In theory, growing earnings translate to growing stock prices, but this is only true if valuation multiples remain the same or rise. Some argue that over the long run valuations should mean-revert and therefore wash out of the equation. We would argue that changes in economic fundamentals and market dynamics could lead to ‘regime change’ and semi-permanent shifts in the mean level of valuations. Factors could include the dramatic secular decline in inflation over the past forty years, as well as loosening of regulations on market participation, both of which may also be connected to the third reason.

- Globalisation. Over the past forty years, the world has seen a period of rapid globalisation. This has included a breakdown in the regulations which govern doing business in other countries, and the development of complicated international supply chains. The geographic location of a company’s listing has become increasingly irrelevant – for certain industries at least. This is the overarching reason why the GDP growth of an individual country has increasingly less relevance to the growth of its stock market: many companies’ earnings are increasingly foreign and so linked to foreign GDP growth.

Even if GDP growth does not determine market growth, we would argue that the two chief drivers of GDP growth, labour growth and productivity growth, are key determinants of company earnings.

These drivers are therefore also key determinants of individual company returns, even if valuations can be more important in the short term.

As a result, investors need to analyse these drivers on an individual company level rather than at the national level, which is where selecting a strong stock-picking manager becomes crucial. Below we consider the three main ways that economic fundamentals are relevant to successful investing in emerging Asia.

Three reasons to invest in emerging Asia

1. Demographics

The number of workers in an economy is a key determinant of its potential GDP growth. Put simply, more people can produce more.

Demographics have therefore long been a boon to the economies of much of developing Asia, in contrast to the European situation.

The picture is changing, however, with China’s workforce now declining as more people leave the workforce due to old age than enter it.

‘The number of workers in an economy is a key determinant of its potential GDP growth’

China is now therefore on the same path as Europe, albeit from a much lower base. Nevertheless other Asian countries still benefit from an improving demographic picture.

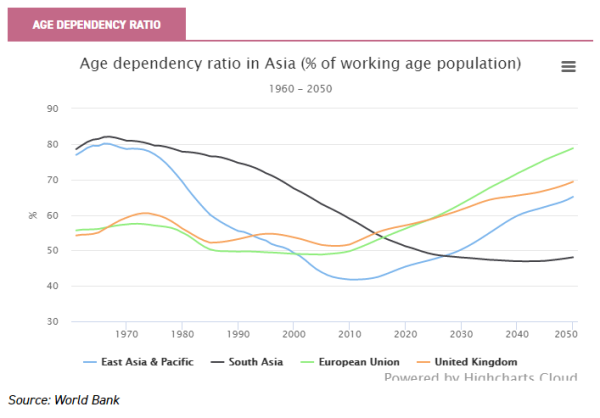

The chart below is a simple illustration of these trends. World Bank data shows how the dependency ratio (the ratio of non-working people to working people) has recently ended a multi-decade decline in East Asia and the Pacific, including China.

This ratio is now rising, as it has been in Europe and the UK for some time, although it remains significantly lower in East Asia. This is in contrast to South Asia, which is likely to see the number of workers per dependent continue to rise into the 2030s at least.

An influx of younger workers gives a deeper pool of labour for companies to draw on, which benefits the earnings of companies which have a higher marginal revenue product from adding new workers.

It also means there is a wider market to serve, as younger workers have a higher marginal propensity to consume.

In the largest countries still enjoying this demographic benefit, there is also under-penetration of basic services and goods, which provides huge opportunities for the companies providing them.

Aberdeen New India (ANII) for example, has long held a position in Housing Development Finance Corporation.

This is one of India’s largest mortgage lenders and has been a clear beneficiary, as more and more Indians achieve home ownership.

Aberdeen New India is the top-performing India specialist trust over five years. Its managers aim to uncover companies with stable, long-term earnings potential, as we discussed in our recent update.

Like Ashoka India Equity (AIE), it also has exposure to some consumer staples companies which are benefitting from sales growth into a growing population with rising income levels. We published our first note on this relatively new trust last month.

Both trusts have exposure to the IT sector, through different stocks.

Although this sector is largely exposed to foreign

growth, serving as a source of outsourced work for developed world companies which operate within those economies, the availability of a young, educated workforce is what makes this possible.

Aberdeen Standard Asia Focus (AAS) has significant overweights to several countries with falling dependency ratios. Aside from India, this includes Indonesia and the Philippines.

In fact, OCBC NISP of Indonesia is the largest position in the trust’s portfolio. The bank operates in a market with low penetration of banking services, which means that there are earnings gains to be made by expanding its customer base.

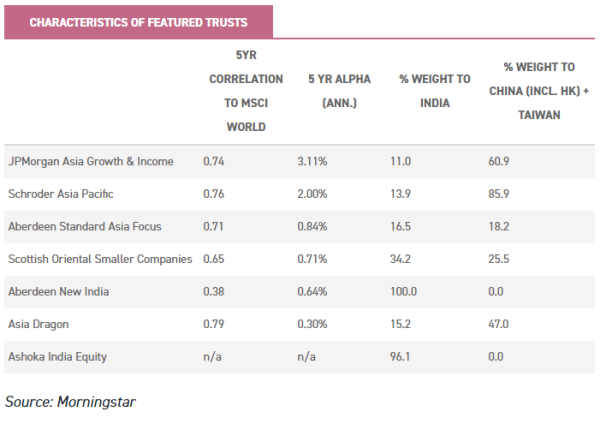

AAS is a small cap focussed trust managed by Hugh Young, with a quality and value approach. Hugh aims to find companies with high and sustainable earnings, typically market-leading companies selling into growing markets.

2. Productivity growth

In less developed countries, a greater effect on GDP growth, and therefore corporate earnings potential, comes from productivity growth; particularly where the growth in the labour force has stalled or reversed.

Factors raising productivity include an initial shift from lower productivity to higher productivity industries, followed later in a country’s development by intra-industry gains.

Starting from a lower base, countries can therefore see greater growth rates in productivity which passes through to greater corporate earnings per labour and capital employed.

‘greater growth rates in productivity which passes through to greater corporate earnings’

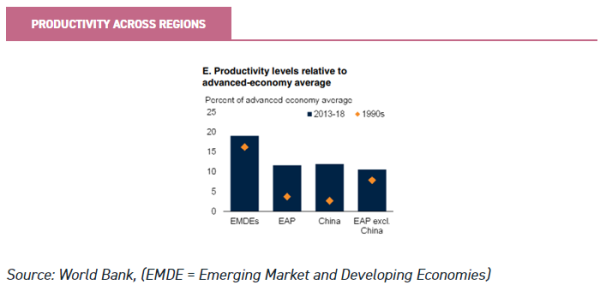

That said, even those emerging Asia countries at later stages of development are still seeing productivity gains in excess of the developed world.

The UK’s productivity growth has slowed to below 1% p.a. in recent years, in line with similarly low levels in the other major developed countries.

By contrast, in the East Asia region productivity growth averaged 6.3% p.a. between 2013 and 2018.

Nevertheless, average output per worker in emerging and developing economies is still less than one-fifth that of a worker in an advanced economy, meaning there is plenty of ground to catch up.

In East Asia Pacific (including China) it is still only roughly 10%, according to World Bank figures3.

New technology is one of the key ways that output per worker can be increased. Technology-intensive industries in particular can have very high levels of output per worker, which benefits investors who identify leading companies in these industries.

The World Bank4 highlights how in emerging markets as a whole there is a huge gap between the most productive companies and the majority of weakly productive companies; which partly explains the lower overall productivity in this region.

It is also, in our view, one reason that stock selection has greater alpha-generating potential in emerging markets. Most of the technology-intensive firms in emerging markets are located in the East Asia and Pacific region.

Among the trusts that have benefitted from exposure to highly productive industries in the region is Aberdeen Standard’s Asia Dragon trust (DGN, formerly Edinburgh Dragon). Asia Dragon’s largest three positions are overweights to Tencent, Samsung and TSMC.

The managers of the Aberdeen Standard Asia Equities team, Adrian Lim and Pruksa Iamthongthong, have been moving the portfolio more into technology-related sectors in recognition of their greater growth potential.

This shift has resulted in strong outperformance against the regional index since mid-2018.

Schroder Asia Pacific (SDP) has an even greater weighting to these sectors. Unlike Asia Dragon, which does not hold Alibaba on corporate governance grounds, SDP is overweight that stock as well as Tencent, Samsung and TSMC.

The overall weighting to IT and consumer discretionary (which houses internet retailers) is 32.8% versus 27.4% for DGN.

When we recently met with the manager, Matthew Dobbs, he explained how he viewed Asia as increasingly a productivity growth rather than a labour force growth story.

As the countries become richer and more developed, generating productivity gains rather than simply adding new workers and consumers is increasingly the most important source of earnings growth.

Nonetheless Matthew does allocate to India and Indonesia when the valuations are right; recognising that there is still plenty of stock-specific potential in these countries at an earlier stage of development than China, and this diversifies the sources of earnings on his portfolio.

3. Diversification

While it doesn’t fit into productivity equations, diversification is another reason to invest in emerging Asia, in our view.

Increasingly at an index level the major emerging markets and the broad emerging markets indices are correlated with the developed world indices, thanks to the progress of globalisation.

Even so there are still sectors, countries and stocks which are less correlated, and exposure to them can provide valuable diversification benefits for investors.

‘sectors, countries and stocks which are less correlated, and exposure to them can provide valuable diversification benefits for investors’

The reasons for a lack of correlation can include regulatory restrictions that create captive local markets.

We have seen this feature develop in the internet-related sectors in Russia and China in particular, where the authoritarian governments want to prevent US companies from running the online infrastructure, giving local champions a free run at a new industry with high marginal returns to resources employed.

As well as the two trusts discussed above, JPMorgan Asia Growth & Income (JAI) also has heavy exposure to Tencent, which is the largest weighting at 7.2% of the trust. Tencent owns WeChat, the Chinese alternative to the Facebook-owned WhatsApp, banned in China since 2017.

However, the trust does not own Baidu, the Chinese equivalent to the blocked Google search engine.

This decision has been a positive contributor to the trust’s returns, highlighting that having a stock-picking manager who understands the strength of the business model, management and industry dynamics is just as important as understanding the sensitivity to economic fundamentals such as productivity growth.

Some countries are themselves less correlated to the major developed world indices.

These are mainly countries at an earlier stage of development, where more of the growth is coming from an expanding labour force and young population: India, Malaysia, Thailand and the Philippines.

Except for the frontier markets of Vietnam, Sri Lanka, Bangladesh and Pakistan, the emerging Asian country with the lowest five-year correlation to the S&P 500 is Indonesia, at 0.34.

‘the emerging Asian country with the lowest five-year correlation to the S&P 500 is Indonesia, at 0.34’

All the countries mentioned except India have low levels of market capitalisation, which is one reason that the Asian small-cap trusts have the most significant weightings to them. Aberdeen Standard Asia Focus has a total of 31% in Thailand, Malaysia and the Philippines.

Scottish Oriental Smaller Companies (SST) has little or nothing in Thailand or Malaysia, but 11.5% in the Philippines on top of its 34% in India.

The all-cap trust with the most significant weighting is Pacific Assets, which has 7.5% in the Philippines on top of 40% in India. It is no surprise that, out of all trusts in the three Asia Pacific sectors, these three have the lowest correlations to the S&P 500 over five years.

Trade wars

As we have said, the process of globalisation means that the larger emerging markets are becoming more interdependent with the developing world.

At the same time, the dependence of other emerging markets on China has been rising.

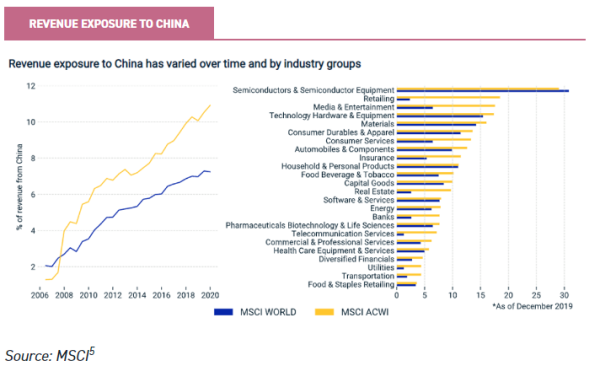

The below chart shows, over time, the revenue exposure to China of the MSCI World and MSCI AC World (which includes emerging markets) on the left, and the exposure by industry in each index, on the right. The East Asia Pacific region now has the highest proportion of firms exporting more than half their sales.

This trend is important because slowing trade as a result of the US/China trade war and the coronavirus will quickly and severely impact countries – even if they are not directly affected by those factors.

Both issues contribute to lower prospects for productivity growth in Asia in the coming years compared to the recent past.

Slowing global trade growth may also incentivise companies to innovate or upgrade products, according to the World Bank. Finding the countries and companies which are less exposed to interregional trade could become more important in future years.

Conclusion

We hope to have shown that, although GDP growth in a particular country is likely to be weakly correlated to its stock market growth, the fundamental drivers of GDP growth are certainly relevant to the prospects for individual companies.

This is particularly relevant to the Asian region, because of its favourable demographics and outlook for strong productivity gains.

‘Good stock-picking managers should be able to deliver considerable amounts of alpha over time’

Good stock-picking managers should be able to deliver considerable amounts of alpha over time, by identifying the companies benefitting from these factors.

In particular the high divergence between high and low productivity companies in the region should make it easier for stock-picking managers to generate alpha.

The fly in the ointment is the retreat from trade liberalisation, which reduces the potential for productivity growth.

Because of the growing connections between the economies of the region, they are increasingly correlated and sensitive to falls in trade.

We can only hope that the coronavirus epidemic calms shortly, and that the dispute between the US and China is resolved without too much damage.

That said, even if the trade war causes a lasting drop in productivity growth in emerging Asia, a good stock-picking manager should be able to identify those companies that will continue to prosper anyway.

[1] OECD (2020), “Long-term baseline projections, No. 103”, OECD Economic Outlook: Statistics and Projections (database), (accessed on 26 February 2020).

[2] William J. Bernstein and Robert D. Arnott, Earnings growth: the two percent dilution, Financial Analyst Journal, September/October 2003, 47 – 55

[3] World Bank, January 2020, Global Economic Prospects: Slow growth, policy challenges

[4] ibid

[5] MSCI Research, February 2012, The coronavirus epidemic: implications for markets

Visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN 480590), registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Leave a Reply

You must be logged in to post a comment.