Jun

2020

Coronavirus: potential impact on income-generating funds

DIY Investor

2 June 2020

We hope the impact of the tragic COVID-19 coronavirus pandemic is as short lived as possible. Our first thoughts are that you and your loved ones remain healthy. While the coronavirus has caused major changes to many of our lives, it also has implications from an investment perspective.

Coronavirus and its impact on income from funds

The curtailment of economic activity to help deal with the coronavirus has not only shaken asset markets but will also have an impact on the income that these assets generate.

We recognise the important contribution that income from our funds makes to the lives of many of our investors. The purpose of this update is to set out how the income from your funds might be affected.

Some background to these unprecedented times

This is not the first pandemic to affect the world, but it is the first time that there has been a synchronised shutdown of large parts of the global economy as countries seek to contain the virus and prevent their health systems being overburdened.

While central banks have flooded the economy with money to provide economic stimulus and many governments have put in place programmes to retain jobs and support companies, there will still be a huge economic cost.

the worst global downturn since the Great Depression of the 1930s”

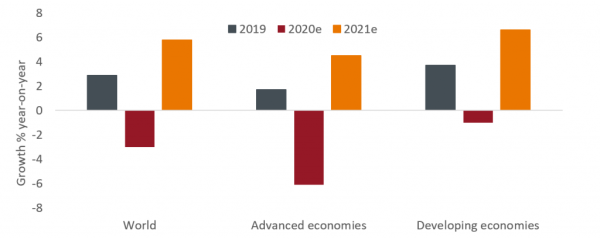

The International Monetary Fund (IMF) estimates that the coronavirus crisis will cause the global economy to shrink by 3% in 2020, with advanced economies faring worse, making this the worst global downturn since the Great Depression of the 1930s.

The IMF anticipates a rebound in 2021 of around 5.8% as economies exit lockdown and stimulus policies bear fruit.

Clearly, these estimates are assumptions and the likelihood of their being accurate rests on the duration and extent of the lockdowns and the success in dealing with COVID-19.

Source: IMF, World Economic Outlook, April 2020. e = estimates. Forecasts are not guaranteed.

The decline in the economy is expected to be most acute in the second quarter of 2020, but it is unlikely that the economy will instantly revert to where it was at the beginning of 2020.

In the absence of a vaccine or viable cure for COVID-19 many economists suggest that it may be 18-24 months before the global economy is back to the same level as the start of this year.

How has the lockdown affected the economy?

With economic activity severely restricted, many companies have seen a collapse in revenues, household income has been put under strain, and government finances have been hit as tax revenues decline.

Consequently, across the economic system there are strains on the ability of some economic participants to make payments to others.

To preserve cash, many companies have cancelled or deferred dividend payments, some tenants are struggling to meet rent payments to property landlords and weaker companies may be unable to meet their coupon payments on bonds.

The effect is not uniform. As ever, there are winners and losers in this environment. For example, the technology and healthcare sectors have typically performed better than retail and leisure sectors in this scenario.

What does this mean for our income funds?

As active managers we endeavour to improve outcomes for investors.

This means, within our income-orientated funds, we seek out investments where the income is likely to be paid, while being mindful of the capital value of the fund.

The abrupt change in the economic outlook in March, however, meant it was not always possible or desirable to reposition away from securities or assets where the income is being deferred or cancelled.

For example, companies that cancel a dividend may go on to reinstate the dividend later in the year or in 2021 so the portfolio manager needs to weigh up whether it is worth selling the share or holding it in anticipation of higher total return (income and capital gain) in the future.

The funds we manage will all perform differently, given the composition of their portfolios.

‘income from bond funds is more mixed and could lead to higher distributions in 2020 in some cases’

In the main, we are expecting income from equity and property funds to be lower in the second and third quarters of 2020 than would otherwise have been the case due to dividend cancellations and potential for rental defaults to increase.

We would anticipate an improving picture in 2021. The outlook for income from bond funds is more mixed and could lead to higher distributions in 2020 in some cases.

Before we look at the impact on each asset class, we should be familiar with what is meant by the term yield.

Yield: The level of income on an investment, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides the dividend payment over the last 12 months by its current share price. For a bond, the simple yield is calculated as the coupon payments over the year divided by the current bond price.

Bonds

Bonds rank above equities in the capital structure and therefore have an earlier claim on payments that a company makes. This means that while companies have the discretion to cut shareholder dividends, they have an obligation to pay the coupons on their bonds.

What is more, where we have seen central bank support measures, these have typically been directed at purchasing bonds, as opposed to other risk assets.

For example, the US Federal Reserve, the European Central Bank and the Bank of England all include government and corporate bond purchases within their asset purchase schemes.

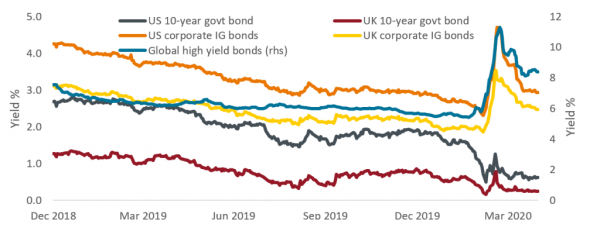

Central banks have cut interest rates to record low levels – to zero or negative in some countries.

‘yields on government bonds in developed economies are near record lows’

Together with measures to bring down the cost of financing, yields on government bonds in developed economies are near record lows.

While the decline in yields represents a valuable capital gain on existing bonds, it means that the ability to reinvest in government bonds at higher yields is curtailed because new bonds that are issued will come with a lower coupon.

Funds with a high weighting to government bonds are expected to see lower income distributions in 2020 as a result but the decline should be small and gradual given that bonds that were issued in the past with a higher coupon should still make up a large part of portfolios.

Index-linked bonds, i.e. those bonds where the coupon adjusts in line with inflation, are expected to offer a higher coupon provided inflation remains positive.

Source: Refinitiv Datastream, yields to maturity for: US 10-year Government Index, UK 10-year Government Index, ICE BofA US Corporate Bond Index, ICE BofA Sterling Corporate Bond Index, ICE BofA Global High Yield Bond Index. 31 December 2018 to 30 April 2020. IG = investment grade. Investment grade bonds are deemed to have a higher credit quality and be less risky than sub-investment grade (high yield) bonds. Yields may vary and are not guaranteed.

In contrast, yields on corporate bonds have risen. In part because corporate bond prices fell but also because investors are now demanding higher yields to lend to companies when they make new issues. There was a discernible downward trend for corporate bond yields that was (temporarily) halted by the coronavirus crisis.

‘funds with a higher weighting to corporate bonds could see higher income distributions in 2020’

The opportunity to reinvest at higher yields means that funds with a higher weighting to corporate bonds could see higher income distributions in 2020 than would have been the case; whether this translates into a higher pence distribution than the same period a year ago or simply an improved outcome (albeit lower pence distribution than 2019) relative to where distributions would have been in 2020, will depend on the composition of the portfolio.

Defaults (the failure of a borrower to meet a repayment to a bondholder) represent a threat to income but defaults are expected to mostly impact sub-investment grade (high yield) bonds.

Conversations with our bond portfolio managers suggest that while defaults within bond markets will be higher this year, the support programmes put in place by central banks and governments should help to subdue the level of defaults.

Equities

For equity income investors the COVID-19 pandemic has also resulted in dramatic implications for dividend payments because of significantly reduced revenues and profits for many businesses.

A number of companies have already announced that they will be suspending or cutting dividend payments this year.

We have seen a significant number of dividend cuts in the UK and Europe, two of the higher dividend yielding regions of the world, while lower yielding regions such as the US have been impacted less at the time of writing.

‘We have seen a significant number of dividend cuts in the UK and Europe’

At a sector level, the government lockdowns implemented around the world to contain the spread of coronavirus have severely impacted businesses in leisure, tourism, airline, retail and construction, among others.

That said, some companies such as those within the utilities, consumer staples, communication services, technology and healthcare sectors, are likely to be more defensively positioned and as a result their dividends should be more resilient despite the challenging economic environment.

Dividend cuts or suspensions are likely to continue as companies look to conserve cash to survive.

There is also intense regulatory, political and societal pressure on companies to withhold or reduce their dividend payments until the impact of the pandemic is clear.

Paying dividends to shareholders while also receiving support from government-backed business loans or employee payment schemes would be hard to justify.

Given this, we believe it is more important than ever to have an active approach to equity income investing where the portfolio managers can actively select companies that may generate sufficient available cash flow to pay a sustainable dividend that ultimately has the ability to grow.

The key question will be how quickly companies that have cut or suspended dividends can return to paying dividends to shareholders once the crisis has subsided.

We do expect many of the companies to return to paying dividends in due course, albeit from a lower base level, but for this year the outlook is uncertain.

All these factors will impact the level of dividend income received and ultimately the income distributions paid by our equity income funds, and our equity funds in general.

UK commercial property

Returns from UK commercial property are predominantly derived from rental income typically paid on a quarterly basis by the tenant that occupies the property.

During the time of the COVID-19 lockdown many businesses have been forced to shut, which has affected the ability of some businesses to pay rent notably within the leisure and retail sectors.

This will, in time, impact the income distributions that UK commercial property funds can make to investors.

For most asset classes, the portfolio manager has little influence on the performance of the underlying asset.

Property is very different. Direct property owners can help shape the returns from the assets they hold.

‘Direct property owners can help shape the returns from the assets they hold’

To help manage the economic effects from the COVID-19 pandemic, our portfolio managers are working with all tenants in the Janus Henderson UK Property PAIF and have offered all to move to monthly rents to assist with their cashflow, should this be something they wish to do.

We believe it is important to support tenants through this challenging time rather than have lots of vacant properties when the crisis is over.

We have also offered vacant space and potential use of car parks in shut assets to the NHS and the government for use where appropriate.

Communicating with tenants has also allowed for in-depth conversations on how the investment team can work with occupiers on sustainability matters and energy efficiencies, and potentially taking longer leases as a trade-off for any rental breaks.

‘We believe it is important to support tenants through this challenging time’

It is worth highlighting that many businesses are still operating within consumer staples, such as food stores, and other essential services, along with the logistics industry and properties occupied by the government and local authorities.

In addition, the majority of rents from our UK Property PAIF have been collected for the first quarter but we do want to manage expectations that, despite the ongoing engagement with tenants, rental payments to the fund are likely to be lower over the coming quarters and that this may impact the fund distributions in time.

We do hope that the information within this note helps to give some clarity in terms of income expectations over the short to medium term.

Please also refer to the Insights section of our website www.janushenderson.com for further updates from our portfolio managers on COVID-19 and other areas of interest.

Past performance is not a guide to future performance. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

The Janus Henderson UK Property PAIF is a Janus Henderson Investors’ product but its management is outsourced and its sub-investment manager is Nuveen Real Estate. This fund and its feeder fund invest in a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of valuer’s opinion rather than fact. The amount raised when a property is sold may be less than the valuation.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.