Sep

2018

Consistency and patience in a changing world: Jupiter European Fund

DIY Investor

11 September 2018

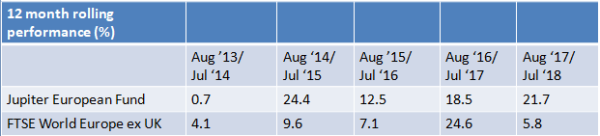

Consistency is at the heart of Alexander Darwall’s investment process. Since joining Jupiter in 1995, he has become the company’s longest-serving fund manager. His steady approach has been through all manner of market events, from the tech bubble to the financial crisis to the eurozone crisis, returning annualised growth of 14.8% for the Jupiter European Fund over ten years, versus the fund benchmark FTSE World Europe ex UK Index of 8.0%.[i]

Consistency is at the heart of Alexander Darwall’s investment process. Since joining Jupiter in 1995, he has become the company’s longest-serving fund manager. His steady approach has been through all manner of market events, from the tech bubble to the financial crisis to the eurozone crisis, returning annualised growth of 14.8% for the Jupiter European Fund over ten years, versus the fund benchmark FTSE World Europe ex UK Index of 8.0%.[i]

Seeking the winners from change and disruption

We live in times of immense change. Shifting consumer habits, demographic challenges, and disruptive technologies are impacting virtually all industries. It is this complexity that underpins my belief that consistency and a repeatable, yet flexible investment process remains the most appropriate approach for investing.

Across the Jupiter European Growth strategies, my team and I hold around 35 companies that we judge to be ‘special’. These are companies that we believe can deliver performance throughout all market conditions, regardless of economic trends.

We look for some key features in these special companies. The majority of my time is spent engaging with company management teams and their boards to discover exactly how they run their business. I only invest in companies that I confidently believe have the right long-term vision, appropriate levels of investment, sensible succession planning and have, ideally, a creative tension between the chairman and CEO.

‘deliver performance throughout all market conditions, regardless of economic trends’

My team and I look for patterns of success across business models, favourable industry structures and truly ‘sustainable’ companies in the sense that they have a credible, profitable business.

We like companies that are in control of their own destinies, that have pricing power and flexible business models. They tend to operate globally and are in industries that have high barriers to entry.

We look for business models that are likely to be winners from disruption, whether from changing consumer habits, technological changes or regulation. Our entire investment process flows from this in-depth knowledge of the business and management.

The question my team and I constantly ask ourselves is: ‘Will this company succeed or fail against technological challenges, changing consumer behaviour and a changing industry landscape?’ Below are a couple examples of the industries we believe present exciting opportunities from change and disruption.

-

The cruising industry

The cruising industry is dominated by three global players. There are very high barriers to entry: a company entering the industry needs a vast amount of capital – just a single cruise liner can cost $1 billion to build and they would need a whole fleet. A strong brand name is also required to source passengers from a fragmented, global customer base. A flexible production and sales model would also need to be established.

‘We look for business models that are likely to be winners from disruption’

Flexibility is a key attribute of the cruising industry in other ways too. If one country goes into recession, the company can source more customers from other countries. Or if a route needs to be altered, perhaps because a particular itinerary falls out of fashion, the company can send ships elsewhere.

This level of flexibility combined with high barriers to entry make it extremely hard for new comers to compete with the giants of the cruising industry, and history has shown us that few try to do so.

The established players also stand to benefit from technological disruption and changing consumer behaviour. For example, new technology has enabled more sophisticated booking systems to improve ticket pricing efficiency and management.

In addition, contactless payment methods on ships can encourage more consumer spending. As companies learn more about their customers through the booking process and spending habits, they can also address consumer expectations of a more personalised holiday. The improved experience explains in part why demand for sea cruises has been growing faster than tourism to land-based alternatives.

-

The clinical diagnostics industry

Healthcare is another sector where we believe winners will emerge, in this case due to industry disruption and regulation. One interesting area are clinical diagnostics equipment companies that are benefiting from changing technology and regulation.

New syndromic diagnostic technologies determine whether patients have an infectious disease in record time, enabling treatment to begin sooner and freeing up hospital beds where they are not needed.

‘a consistent approach to investment has the best chance of achieving a consistent outcome’

Against increasing concerns over the rise of antibiotic resistance, diagnostics companies are benefiting from the drive from health authorities around the world to stem the overuse of broad spectrum antibiotics.

Health authority concerns over mitigating pandemics and reducing the spread of infectious diseases (such as respiratory illnesses and meningitis) are also contributing to demand. Accurate diagnostics also have a role to play in speeding up the search for new antibiotics, as the technology can accurately isolate the disease in trial patients.

Structurally, the clinical diagnostics industry has several attractive features. There are high barriers to entry – any new entrant to the market needs to meet strict regulation (such as FDA approval, which can take several years) and beat high technological standards from existing players.

Conclusion

I believe that a consistent approach to investment has the best chance of achieving a consistent outcome. That is why my team and I continue to engage with the great entrepreneurs of today. Our approach is to understand the inner workings of strong companies, rather than speculating on whether the economy is in a ‘bull’ or ‘bear’ market. There are many exciting opportunities in Europe arising from change and disruption and we continue to work hard to find them.

[i] Past performance is no guide to the future.

Fund performance data is calculated on a NAV to NAV or bid to NAV basis dependent on the period of reporting; all performance is net of fees with net income reinvested. Source: FE, Jupiter European Fund I Acc, in GBP, to 31/07/2018.

The fund tends to invest in fewer companies and may be more volatile than a broadly diversified one. This fund invests mainly in shares and it is likely to experience fluctuations in price which are larger than funds that invest only in bonds and/or cash. The Key Investor Information Document, Supplementary Information Document and Scheme Particulars are available from Jupiter on request.

Important Information This document is for informational purposes only and is not investment advice. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. We recommend you discuss any investment decisions with a financial adviser, particularly if you are unsure whether an investment is suitable. Jupiter is unable to provide investment advice. Past performance is no guide to the future.

The views expressed above are those of the Fund Manager at the time of writing are not necessarily those of Jupiter as a whole and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Company examples are for illustrative purposes only and are not a recommendation to buy or sell. This document contains information based on the FTSE World Europe ex UK Index. ‘FTSE®’ is a trade mark owned by the London Stock Exchange Plc and is used by FTSE International Limited (‘FTSE’) under licence. The FTSE World Europe ex UK Index is calculated by FTSE. FTSE does not sponsor, endorse or promote the product referred to in this document and is not in any way connected to it and does not accept any liability in relation to its issue, operation and trading. All copyright and database rights in the index values and constituent list vest in FTSE. Jupiter Unit Trust Managers Limited (JUTM) and Jupiter Asset Management Limited (JAM), registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ are authorised and regulated by the Financial Conduct Authority. No part of this document may be reproduced in any manner without the prior permission of JUTM or JAM.

[1] Past performance is no guide to the future.

Fund performance data is calculated on a NAV to NAV or bid to NAV basis dependent on the period of reporting; all performance is net of fees with net income reinvested. Source: FE, Jupiter European Fund I Acc, in GBP, to 31/07/2018.

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.