May

2022

What are Structured Investments?

DIY Investor

25 May 2022

A Structured Investment product is a legally binding contract between an investor and a bank whereby you agree to tie up your money for a set period – by Christian Leeming

Unlike a structured deposit where the investor deposits money with the bank, an investor in a structured investment lends money to the bank for the term of the product at the end of which they receive whatever the product pledges to return plus a return of capital, providing certain criteria have been met.

The product return is based on a formula, sometimes based on the performance of the prices of individual shares, but more typically on a share price index, such as the FTSE 100.

‘structured investments are sometimes called ‘capital at risk’’

In contrast to structured deposits, structured investments are sometimes called ‘capital at risk’ or structured capital at risk products – ‘SCARPs’ – because you may lose some of the money you invested; as with structured deposits, the return depends upon the performance of an underlying asset or index.

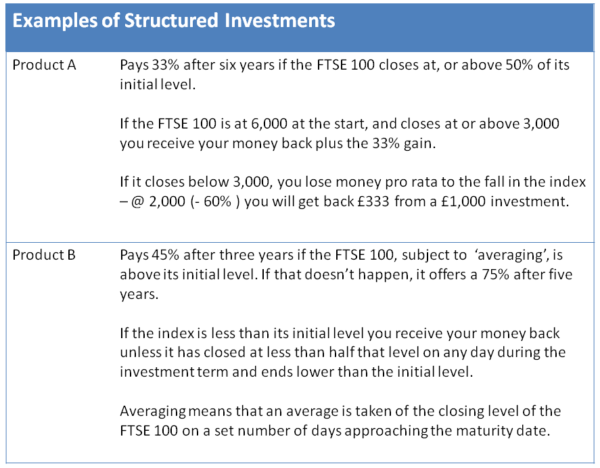

Some examples of rules for structured investments of £1,000 are:

- If the FTSE 100 is higher at the end of the five years than it was at the beginning, you get your original investment back plus an extra 30% – a total of £1,300.

- If the FTSE 100 is at the same level or lower than it was at the beginning, but is less than 50% lower, you get your original investment of £1,000 back but nothing extra.

- If the FTSE 100 has fallen by 50% or more, the amount of your original investment you get back is cut by the same percentage – so if the FTSE 100 has fallen by 60%, you’d only get 40% of your money back, a total of £400.

Other structured investments let you take a regular income and whether or not you get back your original investment in full depends on how the stock market index or other measure has performed. If the stock market falls, you can quickly lose much or even all of your original investment.

‘a structured investment product may deliver greater protection than investing directly in the stock market’

However, a structured investment product may deliver greater protection than investing directly in the stock market by capping your potential losses.

There is a huge variety of types of product, ranging from those offering a pre-set annual return provided the FTSE 100 rises each year; to products promising a fixed return if the index never closes below a set level during the life of the investment; others offer returns based on baskets of shares or companies in a particular sector.

Benefits of Structured Investments

Your potential losses are likely to be less than if you invested directly in the stock market as many products include limits.

The return you achieve may be better return than you could achieve with a cash deposit, or a structured deposit.

The terms of each product include details of what return you can expect under certain circumstances and when you will receive it.

Risks of Structured Investments

Unlike structured deposits, structured investments are not protected by the Financial Services Compensation Scheme (FSCS), so you could lose some or all of your capital if the counterparty fails.

You could lose some of your investment if the underlying assets or index the product is based around perform badly.

At the outset you commit to an investment for the duration of the product but if you need to access your money before the end of the term, you may not be able to cash it in or have to do so at a loss.

Structured investments range from those offering a pre-set annual return provided the FTSE 100 rises each year, to products guaranteeing a fixed return if the index never closes below a set level during the life of the investment.

Others offer returns based on the performance of a number of different indices or baskets of shares or companies in a particular sector.

Structured investments introduce ‘counterparty risk’ as they are effectively loans to an investment bank and returns from the product are predicated upon the bank remaining solvent – no longer a given.

The bank provides the investment and derivatives behind the product and may be different to the company that is promoting the product; the investment is dependent on the financial stability of that bank – and since the financial crisis banks can no longer be considered 100% safe.

Lehman Brothers was counterparty to a large number of structured products and many investors lost substantial sums when it collapsed in 2008.

As a result the Financial Conduct Authority issued strict guidelines about how structured products should be promoted and sold.

Leave a Reply

You must be logged in to post a comment.