Mar

2019

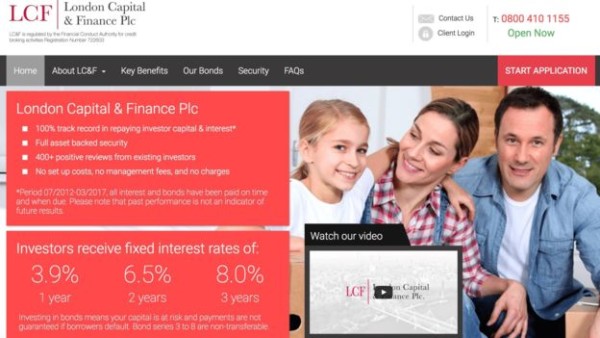

Thousands of investors face losses as London Capital & Finance files for administration

DIY Investor

9 March 2019

As an update to the story below that originally appeared on DIY Investor back in January, reports on the BBC today confirm that London Capital and Finance has collapsed into administration.

The company took £236m following a marketing campaign for a high-risk bond scheme marketed as a ‘Fixed Rate ISA’ that is now under investigation for mis-selling.

Many were first-time investors – inheritance recipients, small business owners or newly retired – who fear they have lost everything after the company collapsed.

Administrators said investors could get as little as 20% of their money back; in a letter to bondholders administrator Finbarr O’Connell said once the £60m to Surge was paid, returns of up to 44% would be required in order for LCF to make good on its promises.

The company paid an agent, Brighton-based Surge PLC, 25% commission – totaling £60m – to run the marketing campaign promising 8% returns from secure ISAs.

In addition a comparison website – run by a company with links to Surge – compared the 1% and 2% return ISAs typically on offer from high street banks with the investments at LCF.

LCF was authorised by regulator the Financial Conduct Authority (FCA) – but the FCA said the authorisation was to provide consumer financial advice, not the sale of bonds or ISAs.

Obviously it is tragic to see investors duped and DIY Investor regularly considers risk and reward and the absolute requirement for you to understand the structure and protections offered by any investment; no one can blame investors for seeking income in this low interest rate environment, but as a rule of thumb if it looks too good to be true, then it probably is.

The FCA said it was ‘unlikely’ investors would be protected under the Financial Services Compensation Scheme (FSCS) but it was “for the FSCS to determine”.

In one of the biggest collapses of its kind in the UK, more than 15,000 vulnerable members of the public are at risk of losing their investment after high risk bond issuer London Capital & Finance, today collapsed into administration.

LC&F raised more than £225m, much of it from elderly investors, by offering investments with interest rates of 8% and more; City watchdog, the Financial Conduct Authority (FCA) launched an investigation into the company before Christmas, subsequently stopping it from raising more money or touching its assets.

‘one of the biggest collapses of its kind in the UK’

An Evening Standard investigation revealed how the company’s products were marketed via price comparison websites operated by a Surge, a company operated by the director of LC&F’s outsourced marketing arm, whilst feigning independence.

Bondholders, some of whom invested over £100,000 in the company have received no interest since the FCA investigation began, and do not currently know how much of their capital they are likely to get back.

News that it was the directors of LC&F rather than external creditors that had filed for administration caused anger from bondholders; barrister and claims handler Jane Sanders of JSCS, demanded that bondholders be allowed to choose their own administrator, saying:

‘We need to hire somebody who specialises in getting money back for investors, and it should be bondholders choosing them, not the company itself,’ adding that bondholders should be able to elect their own administrators when the first creditors’ meeting is held.

LC&F directors appointed Smith & Williamson LLP as joint administrators yesterday; a document it prepared for bondholders outlining the chain of events says: ‘As a result of [the FCA action] LCF has been unable to raise further monies from investors… Professional advice was sought and the company was advised that LCF was insolvent and that it should be placed into administration to provide the best outcome for bondholders and other creditors.’

Notice of the administrators’ appointment was filed in the High Court yesterday and a call handler answering the phone number for the company in insolvency advised bondholders to wait for updates on the website; questions were immediately raised about why the company was reliant on new investors to remain solvent.

The Evening Standard has previously disclosed that LC&F was a lender to companies linked to the founder director Simon Hume-Kendall including a Cornish holiday park, Independent Oil & Gas and Copenhagen listed Atlantic Petroleum.

LC&F also made a loan to River Lodge Equestrian, a stables where Hume-Kendall’s friend Spencer Golding, was a patron; Golding, who is currently banned from serving as a director due to misdeeds in the timeshare business, was involved in LC&F’s fundraising because he helped a deal for it use Surge to raise money from the public.

Hume-Kendall founded LC&F as South-Eastern Counties Finance and left a year later; mutual friend of Hume-Kendall and Golding, and another big hitter in the equestrian world, Andy Thomson, took the reins and rebranded it as LC&F.

In a statement, Smith & Williamson said: ‘Investors in LCF’s mini-bonds were retail clients who were UK taxpayers and who fall into the category of either High Net Worth Individuals, Sophisticated Individuals, Self Certified Sophisticated Individuals or Restricted Investors, as noted on its website.’

‘At this juncture, regrettably we are not in a position to return any monies to Bondholders’

Administrator Finbarr O’Connell added: ‘It is early days, but our role will be to work with LCF’s borrowers, staff, the Security Trustee for the Bondholders, the FCA and other stakeholders to ascertain what needs to be done in order to maximise the returns to the Bondholders. We are especially focusing on the various loans made by the Company to borrowers. At this juncture, regrettably we are not in a position to return any monies to Bondholders.’

S&W’s Adam Stephens, said: ‘There are some 14,000 bondholders with LCF. We are working to ensure that they are all contacted directly and urgently so that they are aware of the situation. We have set up a dedicated call centre and email system. We would ask the Bondholders to bear with us in these early days as there is much to do.’

His colleague Colin Hardman added: ‘We are working using existing LCF personnel, and gathering information relating to the loans LCF made to various borrowers. These loans to borrowers are the major asset of LCF and the Administrators will do nothing to jeopardise the position of the borrowers and hence their ability to repay their debts to the Company.’

The FCA said it ordered the company not to dispose of or deal with its assets last month because it had ‘serious concerns about the way the firm was conducting its business’; its initial concerns were about the way the company was marketing its bonds in a misleading manner.

This will be an anxious time for investors as they wait to see how much, if anything, they can claw back and a salutary lesson for those prepared to take on the risk of such investments in pursuit of eye-catching returns.

For more about the risks of mini bonds read – Caveat Emptor – Mr Bond urges caution when purchasing retail bonds

Leave a Reply

You must be logged in to post a comment.