Jul

2018

The Great British Trade Off – Humbug (investing) fights back

DIY Investor

14 July 2018

I’m plotting and planning to achieve a financial independence with plenty of noughts on the end of it by aggressively investing in funds; The Great British Trade Off competition is one part of that endeavour.

I must say, I’m thoroughly enjoying the GBTO even though I’m being soundly beaten by Fagin. This first quarter of the second year has gone well for me in spite of the sharp correction that happened at the end of June.

Fagin and I started the competition on April the 5th 2017, each of us with £100k of our own money, a year later I’d lost £7500 of it. DUH.

However this financial year has started a great deal better. By mid June I’d made up the previous year’s loss and more…………………result.

Sadly nearly £4000 of that bled away in the next two weeks. The last week of June was the worst week I’ve ever had in twenty years of trading and investing. I lost 33p a minute for every minute of every day (and night) for the entire week. But even so at the end of June I carried a running profit of £3720 from the start of the second year into the second quarter.

Lets drill down into some of the facts and figures and talk about the methodology I use.

‘don’t count them till they hatch, because until they do, they’re eggs not chickens’

METHODOLOGY: I am useless at fundamental analysis. I’ve spent a small fortune with the excellent Robbie Burns, bought and read books, looked long and hard at what Warren Buffet does and doesn’t do, read the excellent Paul Scott’s daily reports and try as I may I don’t get it.

I’m not a forensic accountant so I have to take company accounts at close to face value. Sure I know what the different metrics mean but I cannot seem to pick ‘the wheat from the chaff’ Also I struggle to interpret the statements and the RNS.

Any bloody fool knows what ‘ahead of expectations’ means, the question I got wrong all too often was, was it already in the price? And don’t even get me started about profits warnings two weeks after a positive statement in the annual report.

Bearing all this in mind, it was logical that I invested in funds, where I am in effect contracting out the stock selection to the fund manager (who at least in theory knows what he’s doing). The costs and charges are a little opaque, but there’s a price to pay for everything in life.

The other big advantage of funds is that you can ‘buy into’ any sector in any part of the world with a product that is traded in London.

Further, with the aid of the brilliant Sharescope program (not cheap, but worth every penny and by the way I don’t get paid to promote them) I can easily find which funds are currently out performing ‘their’ sector.

Given, that apart from simple tracker funds almost all other funds have a fairly narrow remit over what they do and don’t invest in and therefore will always have periods of under performance, average performance and what I look for, out performance.

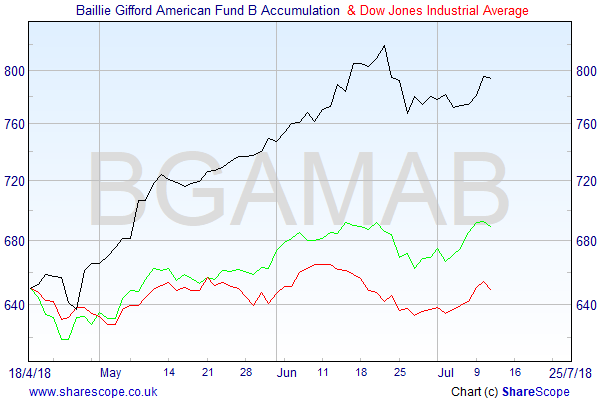

Here’s a good example, the last four months of the Baillie Gifford American Fund (black line) against the Dow (red line) and the Nasdaq 100 (green line)

As you see, the fund has significantly outperformed the two indexes. If your looking to out perform the market, not much point in putting your money in an index tracker is there? I set Sharescope up to go hunting for these situations where a fund is setting up to be ahead of the curve. Basically what I’m trying to do is always have my money where the action is.

FACTS AND FIGURES: After a bad year last year, I started this year with Great British Trade Off capital of £92,500. At the end of the first quarter of the current year I had a running profit of £3720 or 4%. 4% a quarter compounded up is almost 18% a year.

But stock market profits are a bit like chickens. Best you don’t count them till they hatch, because until they do……………………………….they’re eggs not chickens.

So yeah, a really good start to the year, but better to make the money before I bank it.

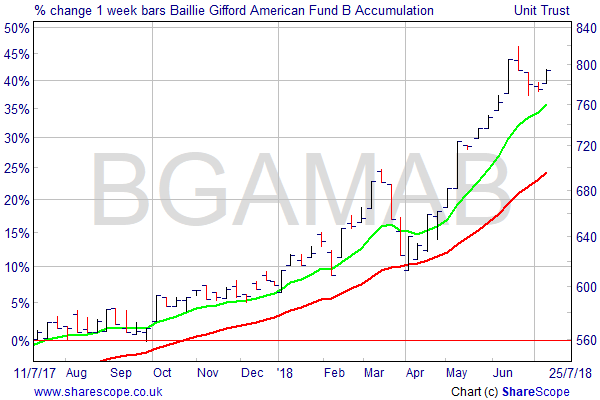

My best performing fund has been the Ballie Gifford American Fund

I’m up 22% since I bought in in April. But sadly only have £5k invested. The ‘Trump Bump’ is still very much in evidence and if I get a chance I’ll be looking to put another £5k into the fund, I just need a bit of weakness to take the price down below the two week average (the green line) and for it to then pivot back up………………………………………and I’ll be in.

‘I’ll engage in masterly inactivity’

You might well ask, ‘why don’t I just buy the damn thing anyway?’ The answer is that I’ve learnt the hard way to never ever chase prices again, so until such time as it makes my buying signal, I’ll engage in masterly inactivity.

I did fret and I do fret about what I think are crazy valuations for tech stocks, I just can’t get my head round the multiples. But hey, trade what you see, not what you think. So I did and £20k of my money is in the sector.

I’ve three holdings, the Neptune Global Technology Fund is my most profitable, up 17%. The AXA Framlingham Global Technology Fund is up 16% and the Polar Capital Global Technology Fund up 10%. Sod’s law being what it is, that’s the fund with £10k in, the other two each having £5k.

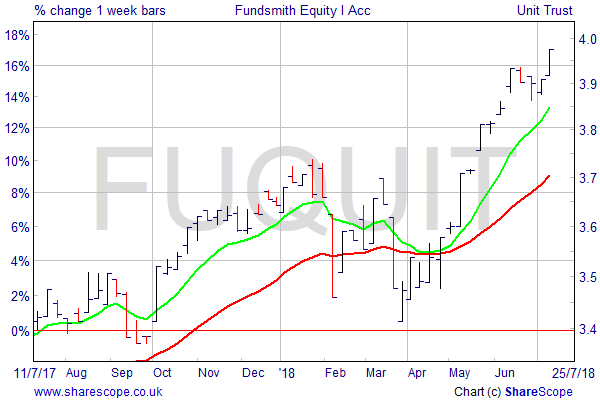

I’m a big fan of the no nonsense approach of Terry Smith who has a medium size fortune invested in his Fundsmith Equity Fund.My meagre £5k is up 10% since May.

That is some slope of hope is it not? I must say it looks a bit warm to me right now. However I’d like to have £10k in it rather than £5k and will look to top up if/when a correction and pivot back up occur.

All my other holdings are in profit, albeit some only slightly. They are:

- The Neptune Global Alpha Fund

- The Sarasin Food and Agriculture Opportunities Fund

- The Ballie Gifford Japanese Smaller Companies Fund

- The Jupiter UK Smaller Companies Fund

- The Malborough UK Micro-Cap Growth Fund

- The Legg Mason IF Japan Equity Fund

- The Fidelity China Consumer Fund

- The Old Mutual China Equity Fund

- The Gam Star China Equity Fund

(however since the end of June the last four have also been sold, three were stop lossed out to small loss’s. One sold to protect a profit. On aggregate a profit of £370 across the four)

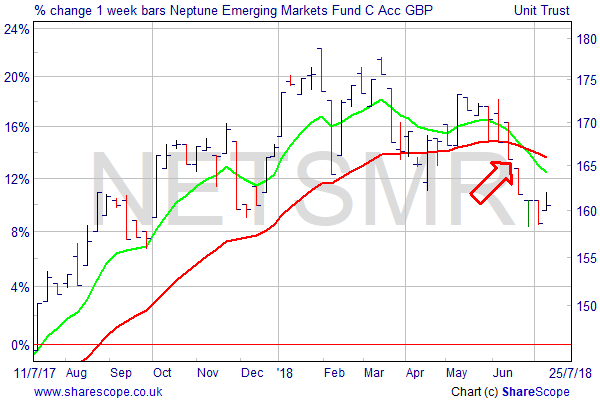

I made only one sale in the quarter, the Neptune Emerging Markets Fund that cost me £270 to stop loss out of my £8k position.

The red arrow shows my departure point and to be honest I’m glad I’m out. The chart doesn’t look pretty.

So thats what has happened. I think my idea of investing only in funds to get round my inability to do fundamental analysis effectively is a good one. Even more so as I’ve tied it into a momentum strategy using my liking for and dare I say it, ability with charts.

I’m not looking for a balanced portfolio anymore and I realise that my aggressive approach of following the hot money does have dangers and clearly isn’t for widows and orphans.

‘you’ve got to risk it for the biscuit’

But hey you’ve got to risk it for the biscuit. I’m seeking to build enough capital for a good level of financial independence. A financial independence with noughts on.

I believe the best way for me to achieve this is to get market beating returns. Easy to say, not so easy to do. But an extra three or four percent compounded up over time transforms the figures.

What do I think going forward into the second quarter?

Wow what a bloody mess. The UK is in such a state, I’ve never seen anything like it in my lifetime..

Beware of politicians who try to be clever. My view is that Teresa May with her latest proposal for Brexit has succeeded in winding up not just Boris Johnson and David Davis but the entire country.

Remainers are deeply unhappy because the proposed deal is far worse than remaining in the EU and leavers are furious because as Boris Johnson so eloquently put it, the deal is a turd.

My guess is that her latest proposal will unravel and the political crisis at Westminster will intensify and spill over into the real world, creating even more volatility going forward.

And boy have we had some volatility in recent times. Wild swings are emotionally difficult for investors in general and for a momentum investor who uses stops as I do, its downright dangerous.

The risk I face in a sideways and volatile market is of being constantly whipsawed in and out of positions and the danger a swing trader like Fagin who takes trades for a few days to a few weeks (depending on how quickly they pan out) is much the same.

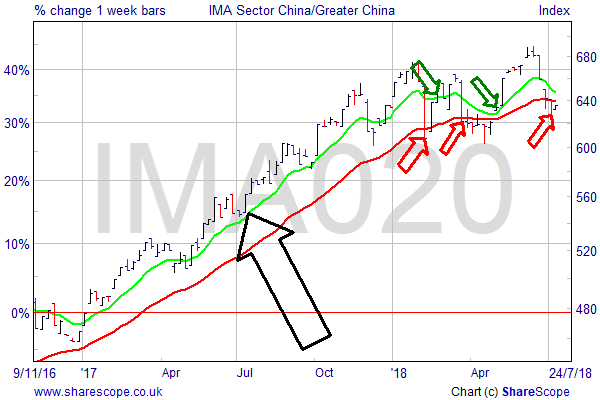

Here is a good example of what I mean.

The black arrow highlights a 30% upswing in about a year and a quarter, then the pattern changes, the three red arrows pinpoint stop positions and the two green ones highlight buying points. As you see, out then back in, then out, then back in, then out.

‘I think conditions are very dangerous I’m just going to carry investing my system’

The difficulty we have is that we invest and trade in the real world and in the real world there is always something happening that has an impact on what we do.

I just cannot get my head round the mess that our cretinous politicians have created, but we are where we are. Although I think conditions are very dangerous I’m just going to carry investing my system. Chart says buy……………..I will, chart says sell………………I will.

Click the image to see more of The Great British Trade Off

Leave a Reply

You must be logged in to post a comment.