Feb

2019

Saving up and drawing down; should you cash in a DB pension?

DIY Investor

8 February 2019

Falling bond yields have driven  up transfer values from final salary or defined benefit (DB) pension schemes. Some of these lump sums are life changing amounts of money and, particularly after the introduction of pensions freedoms (removal of the need to buy an annuity), may look compelling; but transfers are not without risk.

up transfer values from final salary or defined benefit (DB) pension schemes. Some of these lump sums are life changing amounts of money and, particularly after the introduction of pensions freedoms (removal of the need to buy an annuity), may look compelling; but transfers are not without risk.

Growth and income

Key to making the decision to transfer from a DB scheme is future returns; there are two different elements to consider – the growth phase (accumulation) and the drawdown / income phase (decumulation).

Clients and their advisers will have experience of the growth phase (from ISA and SIPP investing when maximising growth and contributions are key – investment risk (volatility) and returns are primary concerns with longevity risk, inflation risk, levels of income and liquidity lower down the list of priorities.

In the income phase, returns are still important, but longevity risk (living longer than the funds will last), liquidity risk (access to income) and matching liabilities (the long-term need for an inflation ‘protected’ income) come more to the fore.

A sustainable level of income while maintaining an appropriate level of capital is key; rather than simply trying to maximise returns, investors are trying to maximise ‘durability’ of income – exactly what the trustees of the DB scheme have been trying to achieve for years! Few investors may be equipped with the skills and knowledge to manage this successfully.

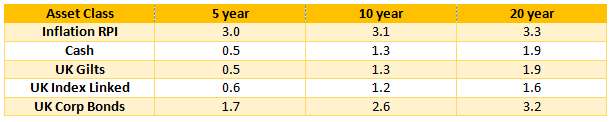

Figure 1. Long term annual real returns from UK assets classes. Source: Barclays

In the long-run, equities have handsomely beaten bonds, but over the last 10 and 20 years this trend has been reversed; returns from bonds (post financial crisis) have been driven up as interest rates and bond yields fell and stayed low, and from the impact of Quantitative Easing (QE).

The fall in bond yields has driven transfer values from DB schemes up (cash equivalent transfer values / CETVs); as the discount rate for future returns has fallen, the cash required today to cancel out a given future liability has risen.

Note: CETVs are driven by the discount rate (usually long dated bond yields adjusted for the scheme asset allocation mix), inflation rates and the scheme demographics. Rising inflation and falling long dated bond yields typically increase transfer values.

Figure 2. Yield on 15-year Gilts over ten years. Source: www.sharingpensions.co.uk

Figure 2. The benchmark 15-year Gilt over ten years highlights the dramatic and consistent fall in yields (and thus rise in bond price).

Falling yields have had several impacts:

• Bond holders – e.g. in Cautious managed funds, have profited handsomely with little apparent risk (volatility);

• DB schemes have bought more and more bonds to match their liabilities which, coupled with QE has forced bond prices up and driven yields down;

• Corporates have issued more bonds as a cheaper source of finance than equity;

• Some, notably Government debt, yields have been driven negative; over $13bn of Government debt around the globe is in negative yield.

Ultra-low yields causes significant risk in bond markets and whilst there is currently no liquidity crunch, rising inflation may trigger a rapid reversal of yields and sharp fall in bond prices; credit markets have historically shown this can be a rapid and violent change in direction.

Low yields also impacted annuity rates which prompted the UK Government to introduce the 2015 pension freedoms which have helped drive greater interest in DB transfers.

Low yields, and corresponding high prices, make bonds potentially an asset class with poor long term value:

Figure 3. Forecast absolute returns for various asset categories. Source: JLT Flash Report December 2016.

Falling bond returns are challenging for DB schemes; they have been forced to pay high prices for now very low returning asset classes, and are now possibly facing rising inflation (and thus rising pension liabilities) that will require higher pay-outs.

Cash returns

Seeing such high CETVs some may shun all investment risk and invest their future pension income in cash; the prospect of rising interest rates may also be attractive.

This is potentially dangerous as the real long term risk they face is inflation; Figure 1. shows cash as consistently the worst returning asset class in real terms over long periods (i.e. retirement).

Many fail to understand how an apparently large cash sum today will last in meeting long term incomes; try to do compound interest or discounting in your head, and it is important to recognise that the personal rate of inflation in decumulation phase ‘pensioner inflation’ is often higher that the published UK CPI or RPI rate.

There is a prospect that investors will take too little risk – too little in assets such as equites and property that protect against inflation – and invest in ‘lower’ risk assets such as cash or bonds which fail to deliver positive returns in the long run let alone real returns.

‘there is a prospect that investors will take too little risk’

Those that do invest in real assets may be unaware of how dangerous sequence of return risk (known as ‘pound cost ravaging’) is to investors. The order or sequence of returns from a portfolio can significantly impact the length of time that the pension pot will ultimately last – up to a decade or more of difference. Poor early returns mean investors need to sell more of their portfolio to generate income.

Keeping a cash reserve, regularly reviewing investments, having a long term, low cost diversified portfolio, while protecting against inflation and not taking too high a level of income are crucial success factors; professional and ongoing advice may be crucial.

Eggs in many baskets

A diversified portfolio that is regularly rebalanced can help minimise downside losses and prevent investors from buying high and selling low; even a simple equally weighted portfolio smooths the up and downs compared to the 12 Investment Association single asset class sector averages.

Pensions freedoms and home equity

Changes in pension legislation and very high CETVs mean that for many their pension will become their largest asset – possibly of much higher value than even their home.

Equity release products are also a factor to consider in long term income provision.

With sensible planning, it is now possible to tax effectively pass pension wealth to future generations, assisted by the new Residence Nil Rate Band for IHT.

It may be better for an investor with a full state pension entitlement, to spend their pension pot faster than a typical annuity / DB pension would allow while they are in good health, knowing that they have equity in their main residence to draw from in later life. The improved ‘quality of life’ that they can enjoy for maybe 10 years with a higher income, could be a compelling reason for a DB transfer to access more flexible benefits

The interaction between the pension and IHT tax regimes, the need for long-term income, the potential need for long term care, the need for a diversified asset mix of real assets inside your pension fund (not just owning a residential property outside your pension fund), the tax effectiveness of investing inside a pension wrapper, the triple lock (or even double lock) on state pension benefits, the enhanced death benefits and IHT planning under pension freedoms all serve to highlight the critical need for professional advice when considering a full or partial transfer of DB scheme benefits.

The state of DB schemes

When planning to transfer from a DB scheme it is worth considering the health of the scheme and the risk of it failing to meet some or all of its future liability; the current level of UK DB scheme deficits is c£300bn.

The Pension Protection Fund (PPF) only covers pensions to a cap which from 1 April 2017 is £38,505.61 per year (£34,655.05 when the 90% level is applied); PPF has approximately £3.5bn of assets and receives c £540m a year in levies so lags the deficit by a wide margin.

‘many will see great value in ‘personal ownership’ of their pension’

The true long term security of any DB scheme is very difficult to assess – current funding, future shocks to liabilities, strength of employer (risk of failure), costs, long term returns and asset liability mix are all factors; as BHS, Tata and a myriad of smaller scheme failures show that DB schemes are no longer absolutely ‘guaranteed’ as they once were.

With most schemes closed to new members, benefits being paid out are higher than contributions in, and the move to reducing ultimate benefits (career average vs final salary definition for pension purposes), many will see great value in ‘personal ownership’ of their pension rather than ‘fractional ownership’ in an opaque pooled DB vehicle.

Why now?

A decade of low inflation may be coming to an end – there are signs of global growth and the UK is seeing the first signs of imported inflation caused by the falling value of sterling post Brexit.

Asset managers are warning about the risk to capital of holding bonds in the expectation of growth and thus inflation and interest rates picking up.

If inflation rises, and / or bond liquidity dries up, the fall in bond values may be sharp (lower interest rates increase bond duration making them even more sensitive to yield changes).

Some investors will take the view that a DC ‘pot’ in their own name is more secure than a ‘promise’ in a DB scheme: larger deferred DB pensioners have less protection under the Pension Protection Scheme, the costs of a DB scheme are impossible to assess and the long duration of DB schemes bond assets can cause very sharp changes in solvency.

A rise in interest rates would be good for an annuity purchase from DC schemes, and the same would be true of a buyout from a DB scheme – except that the rise would have impacted the asset valuation of the DB scheme – whereas an appropriate asset allocation in a DC scheme could mitigate this.

High CETVs.

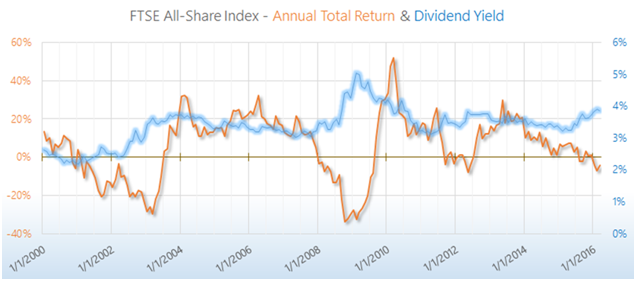

It is easy to see why a transfer value, based on bond yields of less than 1%, invested in a broad equity portfolio, with a 3-4% dividend yield could make a move from DB to DC worthy of consideration at least from a long-term investment return perspective; witness how steady the dividend yield has been from FTSE ALL Share companies – Figure 4.

Figure 4. FTSE All-Share Index Dividend Yields (blue) and Annual Total Returns (red). Source: Siblis Research

In the weeds

Without specialist advice many see only a binary choice between DB guarantees or DC non-guarantee; this does not have to be true – a short term (guaranteed) annuity (purchased with part of a DB transfer) can be used to bridge the income gap to state pension age, or secure a guarantee of nil rate income tax band for non-earners.

There is a rising demand and development in the annuity market (long term guarantees up to 30 years) which offer valuable protection (built in death benefit).

Anything else?

Other reasons for transferring away from a DB Scheme might include:

- Desire to change retirement date (earlier or later)

- Need to provide for a different range of dependants (or none)

- Desire to change tax position / tax free cash amount

- Need to change inflation / escalation rate on pension

- Need to meet a changing work pattern (part time)

- Desire to access lump sum, no income

- Someone in poor health able to secure an enhanced annuity

- Access lump sum and pass effectively onto heirs

Reasons to remain include the loss of a ‘guaranteed’ pension, the risk of poor investment returns, poor transfer value relative to pension deferred. The fact that this may be the only / main source of retirement income would also mean careful thought and consideration is needed before embarking on this route.

Solutions

Any DC replacement for DB benefits should pay attention to the following investment criteria:

- Strategic asset allocation (and risk profile) to deliver inflation protection (growth and drawdown)

- Diversified asset mix in the growth phase to maximise risk adjusted returns

- Assets matched with the long-term income liability (e.g. selling low risk assets first and having a growing percentage of equity assets over time)

- A cash buffer (in drawdown) to mitigate against ‘sequence of return’ risk

- The impact of all costs – funds, dealing, platforms, tax wrappers and advice

- Time horizon for the growth and drawdown stages

- Tax management strategies to minimise losses from taxation

- The need for regular review

All these point to the critical importance of specialist professional advice – both in the transfer decision and on an ongoing basis. Indeed, any DB transfer over £30,000 is required to be ‘advised’ by a suitably qualified adviser.

Summary

Moving from DB to DC is not solely a pure investment decision, but the investment case of aligning an individual’s assets to provide a long-term income liability by investing in real assets is strong.

Even when critical yield calculations are not favourable a client need for flexibility (type, date, style) of income, varying death benefits, ability to work part time, to enjoy a period of travel in good health, to fund children’s education / house purchase, to repay debt (an important ‘mindset’ move into their retirement phase), the interaction with future equity release from a main residence, other invested assets or simply to enjoy the lifestyle they have been working towards for 40 years may be compelling.

Armed with a professional financial adviser (coach), a low cost well diversified portfolio and a sensible approach to investment and income provision, the opportunity presented by all-time high CETVs make a transfer a once in a lifetime opportunity.

With thanks to Janice Russell, Specialist Pension Adviser at Russell Retirement Solutions for her valuable input.

One response to “Saving up and drawing down; should you cash in a DB pension?”

Leave a Reply

You must be logged in to post a comment.

[…] Many DB schemes are currently in deficit and operators are offering extremely high multiples of the expected annual benefit to those agreeing to exit the scheme; this is something that can never be undertaken without professional financial advice. More here […]