Nov

2018

More a time for asbestos underwear than sunshades; Thoughts of Saltydog Investor

DIY Investor

24 November 2018

It’s inevitable that you will lose sometimes. The trick is not to make a habit of it!

I have no mind-blowing observations to make, but then those of you who read my emails are already aware of that fact. I am not in the business of forecasting the future. I will report that the tide is coming in, but only when my feet get wet.

‘More a time for asbestos underwear than sunshades!’

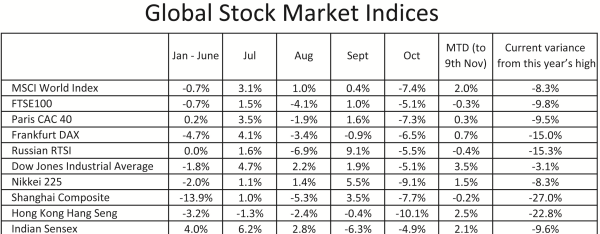

Stock markets, as you can see from the table below, are showing drops of anything between 3% and 30% from their highs earlier this year. The only important question to ask is which way will they move now?

These corrections occur at regular intervals, and normally after such an event one watches and waits for the signs of a recovery. Not so this time. World debt, Mr Trump and Brexit all combine together to make me feel that there is more pain to come. More a time for asbestos underwear than sunshades!

Source: Morningstar

I hope that those of you who subscribe to Saltydog have followed the direction of our own portfolios, and like me are sitting on large percentages of cash.

When the world changes then you can use this cash to move into the new progressing sectors, leaving behind those areas that are failing. It is not much fun at the moment making no gain from the cash, but it is surely better than losing.

‘sitting on large percentages of cash’

It would be worse to be fully invested all through a crash and then try to recover with half your initial investment already lost when the markets start to pick up. That would be like starting a game of strip poker already naked. Rather like the UK Brexit negotiations!

I recently read an interesting observation about the American economy. We are all aware that the Fed intends to continue to lift interest rates throughout next year with the possibility that US Bond rates would follow on and could reach 4%.

That alone would possibly mark the end of the meteoric rise of growth stocks such as the FAANG businesses. These companies are due a correction and that could be the banana skin that sets it off.

The other interesting observation was that the FED has stopped doing Q.E. and is set to recover much of these monies.

What I had not been aware of was that it was the intention of the American government to spend more than $700billion on defence with this money aimed at American manufacturing and development companies.

This is simply Q.E. in a different guise.

Less being purchased abroad, and in particular from China. It is a sad thought but perhaps this, along with the trade wars already launched, means America is already involved in a second cold war. This time with China!

On a lighter note I read a paragraph written by Merryn Somerset Webb which gives an explanation as to why Momentum Investing, although successful, does not receive much press.

She wrote, ‘Fund management companies are mostly paid a percentage of the assets they have under management. In the main, it is easier to get in new assets by getting a good marketing manager to tell an interesting stock market story to investors, than it is to grow by performing well.

After all, what kind of marketing story would include the words ‘we just buy the stuff that is going up and sell that which is going down.’

Spot on Merryn!

Douglas.

Founder & Chairman

Leave a Reply

You must be logged in to post a comment.