Mar

2018

Is investing in blockchain dead following crypto crash?

DIY Investor

29 March 2018

For anyone who’s invested in a cryptocurrency (hereon referred to cryptos) or blockchain related stock, the past few months and weeks have been a corkscrew twister of a rollercoaster ride – writes Angus Campbell of Stature PR

For anyone who’s invested in a cryptocurrency (hereon referred to cryptos) or blockchain related stock, the past few months and weeks have been a corkscrew twister of a rollercoaster ride – writes Angus Campbell of Stature PR

On top of this the most recent trend has been in a downward direction as the fizz in the sector looks to have evaporated, testing the nerve of many an investor who may have got in at levels higher than where most prices stand today.

But let’s go back to basics here as investors interested in this space should ensure that they know the difference between cryptos and the underlying blockchain technology itself, which will equally help to explain what opportunities lie in both areas.

The simplest explanation is that cryptos rely on blockchain, but blockchain does not rely on cryptos.

‘cryptos rely on blockchain, but blockchain does not rely on cryptos’

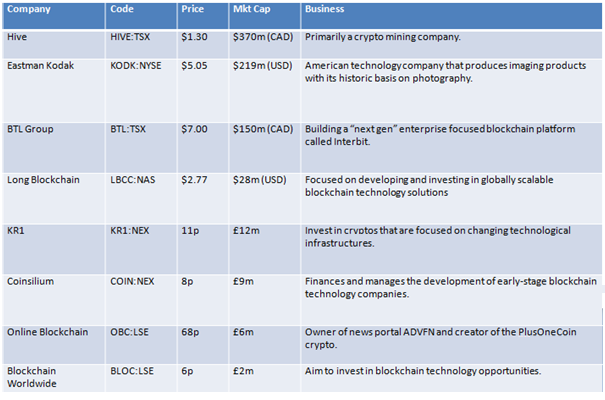

There is an increasing number of listed stocks that are involved in the blockchain space. For regular DIY readers you will recall an article I wrote on the subject a year ago (here) where I tabulated only five stocks. These remain listed below but along with a far larger list that is by no means exhaustive and likely to grow going forward.

Around the turn of the year it was fashionable to change your company name altogether or simply to include the word ‘blockchain’, which would usually lead to a corresponding jump in the stock price.

Examples include Online PLC changing to Online Blockchain, Long Island Iced Tea renamed to Long Blockchain, Stapleton Capital changed altogether to Blockchain Worldwide and even the once beloved Kodak announced its foray into the blockchain space which sent its stock rocketing.

Sceptics will say this is the internet boom all over again when struggling or failing companies would put ‘.com’ on the end of their name and see similar share price surges, but in many cases if you look at the reasons as to why the shift into blockchain is being made, there are perfectly sensible explanations and business cases.

So what is the fuss all about? Going back to ensuring investors understand the difference between cryptos and blockchain itself it’s worth having a brief explanation of what the two actually are. A crypto is a digitalised ‘token’ or ‘coin’ that is created by a computer program to serve the purpose of monetising a network. So crypto is just one application that uses blockchain technology.

Blockchain (often referred to as distributed ledger technology or DLT) is the technology that advocates see as a new and better way of computing.

‘if you look at the reasons as to why the shift into blockchain is being made, there are perfectly sensible explanations and business cases’

In essence blockchain allows everyone in a network (for example an internal team within a company or multiple participants made up of many different companies) to hold a copy of exactly the same database and when anyone makes a change to their database, everyone else’s database is updated accordingly.

This means people or entities transacting or working together don’t have to host or maintain their own separate systems and then reconcile information to ensure everyone is keeping track of activity correctly. It provides built-in security and redundancy, meaning you can use blockchain technology to build applications using far less code than if you were to use existing technology architectures.

This leads us onto the opportunities and tabulated and ranked by market capitalisation below is a by no means exhaustive list of listed firms involved in the space.

Some are mining or investing in cryptocurrencies, others are building or investing in blockchain technology itself. So, for any investors looking to enter this space, they need to understand whether they are investing in a stock that is directly exposed to cryptocurrencies, a stock that is involved in blockchain technology or both.

Twitter: https://twitter.com/angusjmcampbell

Disclaimer: This article does not contain and should be construed as containing investment advice or an investment recommendation or an offer of or solicitation for any transactions in financial instruments. Any opinions made may be personal to the author and may not reflect the opinions of my employer.

To learn more about the cryptocurrencies vying for the top spot see Off to the Races: Cryptocurrencies 101

Alternative investments Commentary » Alternative investments Latest » Commentary » Equities » Equities Commentary » Equities Latest » Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.