Nov

2019

Investing in funds using charts

DIY Investor

20 November 2019

Since 2014 ‘Humbug’ – on account of his demeanour, or the fact that he owns an exquisite sweet shop; you pays your money and takes your choice – was the author of Diary of a DIY Investor – entertaining a loyal following with the thrills and spills of his mainly small cap trading.

Following the Brexit vote, Humbug found it increasingly difficult to apply his system, because markets had become illogical and difficult to read, so he moved to the main market.

Humbug and trading partner, ‘Fagin’ – he picks the market’s pocket – developed a swing trading system, and conceived The Great British Trade Off to see whether a slow and steady, long term investment strategy, would trump Fagin’s wham, bang, ‘thank you kindly guv’ trading approach; trading vs investing, £100,000 of their own money.

Humbug uses the weekly signals to trade/invest for weeks, months and possibly the whole year; decided that the analysis required to pick individual stocks was unduly onerous, so he is now trading funds, but in a style intended to achieve aggressive returns.

I simply do not understand how to make money using fundamental analysis; I’ve tried, I really have. I’ve read books on the subject, looked at the excellent on-line articles by Phil Oakley, read Paul Scott’s daily share briefing and spent literally thousands of pounds going on courses.

‘trading funds is a very sensible, solid way to invest in my opinion’

All to no avail; is it ‘cos I is stupid? Well maybe I am, but I think not.

I totally get the principles and understand the various ratios, but when I try to put fundamental analysis into practise and use it to predict future price movements and thus make money, I fail totally.

What is the point of buying into something that you’re fairly confident is undervalued…………..if no one else agrees and it remains undervalued and doesn’t go upwards towards fair value?

For almost all of the past twenty years that I’ve ‘played’ the markets, I’ve been a short term trader, and a reasonably successful one. But a health scare a couple of years ago made me question the risk/reward elements of what I was doing and the time and effort involved.

I begun to wonder should I become more of an investor than a trader?

‘I invest and trade as part of my drive to create financial independence; financial freedom might be a better way of putting it’

To cut a long story short, I was talking about my concerns to my business partner Simon one day and he felt strongly that I was making a mistake in thinking about changing.

We talked at length about the different issues and in the end challenged each other to see which method would generate a better rate of return. Would it be trading or would it be investing?

It’s almost two years since that discussion and in this last year I must confess that I’ve been trading again as well as investing, but the first year I only invested. That year I got destroyed as Simon walked it. He made a profit of £34k using a £100k of capital, I lost £7.5k.

Without wanting to take anything away from a brilliant performance on his part, I initially found the change of discipline between trading which I was used to and investing which I wasn’t, very difficult and I spent a lot of time kicking the ball into my own goal. DUH.

However I’m a quick learner and I hate losing my hard earned money, so eighteen months ago I took radical action. I went away sailing on my own and spent hours and hours away from all distractions thinking about what I was trying to do.

I invest and trade as part of my drive to create financial independence; financial freedom might be a better way of putting it.

I like nice things, I just do, so for me having enough money to say to myself that I have complete financial independence or freedom involves having assets with lots of noughts on the end of them.

To state the bleeding obvious, you don’t achieve that by incorrectly investing in things that fall in value do you? I really did need a rethink.

With either trading or investing you have to use a style that suits your personality. I greatly like the fast paced action that trading involves, but I was seriously questioning whether I wanted to take large positions in volatile company’s like gold miners and then have to sit and ‘guard’ the trades.

‘You’re crap at fundamental analysis, so outsource it by buying funds not individual shares’

It’s strange how our sub-conscious mind works is it not. Set it a task and it beavers away in the background without any conscious effort. One evening on the boat it suddenly came to me.

‘You’re crap at fundamental analysis, so outsource it by buying funds not individual shares’.

‘You’re quite good with charts, so use them to spot momentum and invest when you see it. Use your trader’s eye to spot entry and exit points and use stop loss’s’. ‘Work out an automatic system and just follow it.’

I’ve normally not got a lot of time for ticking boxes, but these ideas ticked all my boxes. I was going to invest my money with the mindset of a trader but wasn’t going to be trading.

Sure, I would cut things quickly if the momentum I thought I’d spotted failed to materialise, but I was after the big money that comes from the big move. I’d only be checking my results for an hour once a week, instead of every hour of every day.

Wow I thought, that is so simple, can it really work? The answer is yes it can, because it does. Last year was a very difficult year in the markets but I beat the FTSE All Share Index by some 4%, showed a profit and almost level pegged with Simon. As a separate issue I also took up active trading again, trading pivot points and breakouts, but those figures are in a different account.

‘You’re quite good with charts, so use them to spot momentum and invest when you see it’

Let’s take a very quick look at how I invest in funds using charts and show you a couple of examples from last year.

First of all investing in funds has got a lot cheaper in recent years, certainly there are extra costs on top of the market but they’re not as onerous as they once were. A number of the fund supermarkets no longer charge an upfront percentage fee to invest and there are no obvious buying/selling spreads on most funds.

There is no stamp duty on the purchase price and you can take a position on any number of sectors in any part of the world with funds traded in London and generally with most funds liquidity isn’t an issue.

What’s not to like? Well there are annual percentage costs plus platform fees, but they were never going to be free were they?

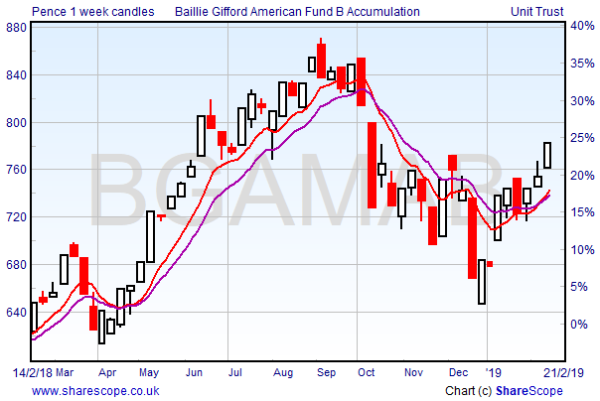

Baillie Gifford American Fund was my most successful trade netting just over £1,300 profit in that sweep up from April to October. The moving averages put me in in May and took me out at the end of September, with momentum you never catch the whole of the move because you don’t know a trend has started until it has and you don’t know it’s ended..…until it has.

The moving averages keep me on the side-lines in cash through the down turn in the Autumn and are just about to put me back in, albeit a long way off the low point at the turn of the year.

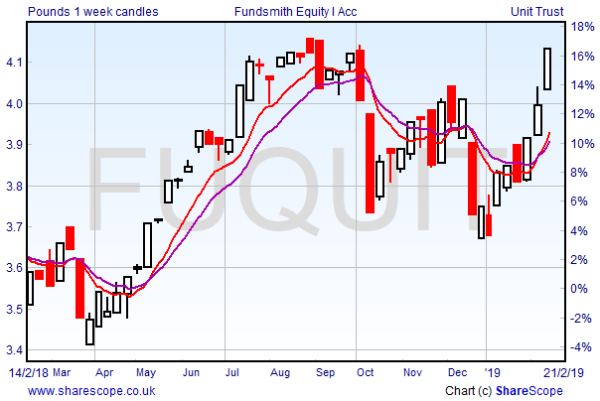

I only made £650 with Fundsmith Equity Fund as I mucked the timing up somewhat which was a bit stupid, but hey ho!

With these trades the buying trigger is the red line crossing the purple to the upside, the trade is held for as long as the red holds position, the trade is closed when it reverses.

I’d like to tell you how difficult it is and how clever I am, but I’m not and it isn’t. It really is that simple; buy when this happens, sell when that happens. I use the brilliant ShareScope programme to find out which funds are on the move and hop on for part of the ride. There’s a bit more jiggery pokery to it than that, but not much.

‘I’d like to tell you how difficult it is and how clever I am, but I’m not and it isn’t. It really is that simple; buy when this happens, sell when that happens.’

Checking out what or what not to do, usually takes me about an hour a week and trades can be placed anytime whether the market is open or not.

Its all so cool and calm, boring might be another way of describing it, that sometimes I have to check my pulse to make sure I’m still alive.

I’m not going to pretend that every trade has a happy ending, because they don’t. But with sensible risk control and stop losses in place, trading funds is a very sensible, solid way to invest in my opinion.

Not least because they’re a good way for an investor to spread both company and geographical risk.

If you’re interested in finding out more about how Simon and I trade not just funds but momentum in general, using moving averages, pivot points and breakouts, please check out our new website.

We’re now live at

https://thenimbletrader.co.uk/

I hope you found this article helpful, please never forget that all my articles and website content are for education and entertainment only, I’m telling you what I think, will do or have done. Nothing I ever post is an inducement to buy, sell or hold any security. Always do your own research and if in any doubt consult a suitably qualified financial advisor.

Focus on Funds Magazine: Passionate about active investment management

Click the image to view issue 1

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.