May

2018

Investing for income in a lower-for-longer world

DIY Investor

5 May 2018

With interest rates close to record lows, investors now need to cast the net wider than ever before in their search for an attractive and sustainable level of income. And investing in shares of investment trust companies in order to receive enhanced dividends can offer some compelling advantages for income-seeking investors. We may now have entered a new era of rate normalisation, but income remains a key factor for investors around the world and will remain a major component of total return for many portfolios.

to record lows, investors now need to cast the net wider than ever before in their search for an attractive and sustainable level of income. And investing in shares of investment trust companies in order to receive enhanced dividends can offer some compelling advantages for income-seeking investors. We may now have entered a new era of rate normalisation, but income remains a key factor for investors around the world and will remain a major component of total return for many portfolios.

Investments come with the power to generate a reasonable income. They can also protect—or even increase—capital value. Cash investments used to do exactly that, back in the days of higher interest rates, such as when the Bank of England held the base rate held at 4% or higher from February 2004 to October 2008.

But it’s getting harder for people to meet their income needs from traditional investment sources, and that includes cash. Parking savings in a bank account and leaving them there, or investing in government bonds, might seem like the “safe option”. However, with income needs rising and interest rates so low, keeping savings in a lower-risk investment like cash could mean accepting an income that is much lower than they need.

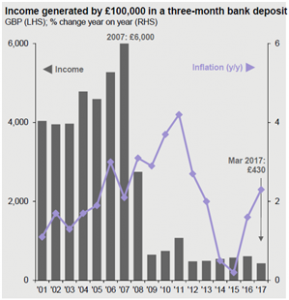

In fact, the chart below shows that investors that had put £100,000 into a three-month bank deposit in 2000 would have made just £430 today.

Many forms of traditional fixed income have fared little better, with gilts and UK corporate bonds barely keeping up with consumer price inflation increases. So if investors are planning on using that income to reinvest for long-term growth, there is a real risk that they will fall well behind their investment goals, forcing them to take on more risk in the future to make up for lost ground.

income have fared little better, with gilts and UK corporate bonds barely keeping up with consumer price inflation increases. So if investors are planning on using that income to reinvest for long-term growth, there is a real risk that they will fall well behind their investment goals, forcing them to take on more risk in the future to make up for lost ground.

Source: Bloomberg, ONS, J.P. Morgan Asset Management; data as of 31 March 2017

There’s no doubt that lower-risk investments, such as government bonds and cash, still have their place in income portfolios: after all, they can help to bring greater stability over the longer term. But in the current low interest rate environment, investors in search of an income stream above the rate of inflation need to move up the risk scale into higher-yielding assets such as dividend-paying stocks.

Enhanced dividends hold an intuitive appeal for income investors

Dividend-paying stocks are providing an increasingly popular way to generate a strong and sustainable income. Dividends are linked to company earnings, so they tend to keep up with inflation over time, while dividend payers also tend to be large, financially stable companies and so the income they produce can be less vulnerable to economic cycles.

Shares can provide dividend income, but when company profits fall, dividends may be at risk. And many companies choose to reinvest profits for future growth and share price gains, rather than pay high dividends. Companies with a track record of paying high dividends are not necessarily those with the best potential for income growth in the future. So for investors looking for regular income, there are drawbacks to putting their money in shares.

The power to pay more than “paper profits”

Some years ago, investment trust companies were not allowed to pay dividends to their shareholders out of the capital gains from increases in the market value of the investments they held. But in 2012, this restriction was removed. This means that as long as investment trusts have amended their articles of association to allow this change, they now have the power to pay dividends out of the capital gains on their investments, as well as from the dividends or interest that the investments earn. Dividends payable from a combination of profits and capital gains on investment are known as enhanced dividends. If company profits and stock markets are buoyant, enhanced dividends can provide a relatively high income each year.

Enhanced dividends can be particularly attractive to certain types of investors who want to receive a regular annual income but at the same time maintain (or even increase) the capital value of their investments. Other investors also look to invest in shares that pay high dividends, because dividends payments are tangible investment return, whereas longer-term capital gains are more uncertain and may turn out to be illusory if unrealised gains (or ‘paper profits’) recede before being taken.

The potential benefits of investing in shares of investment trust companies in order to receive enhanced dividends offer clear advantages to income investors, with the actual amount of dividend payments depending on the performance of the shares that the investment trust holds.

Balancing short- and long-term objectives

When it comes to investing, there’s no such thing as a free lunch. And what’s good for income investors is unlikely to be as good for long-term investors. Long-term investors want a healthy return from capital gains, rather than big dividends on their investments: that’s because if an investment trust pays enhanced dividends out of capital reserves, the potential for longer-term capital appreciation is lower.

So what’s the answer? Investment trusts therefore need to balance the shorter-term objective of adopting an enhanced dividend policy to pay higher dividends with the need to protect shareholder interests and capital value over the longer term.

The power to deliver income and growth

Despite these challenges, a policy of paying enhanced dividends can make it possible for investment trust companies to satisfy investors’ needs for dividend income today and also some capital gain tomorrow. They can invest in the shares of companies with strong prospects for growth and capital gain, without having to ‘chase yield’ and invest in high-dividend companies, because they can pay dividends out of the capital gains that their investments enjoy.

Of course, there’s a risk that investment trusts might pay out too much in dividends and so reduce their capital reserves to a point where future prospects are damaged. This is why the boards of investment trust companies regularly review their enhanced dividend policy, and the size of their dividend pay-outs, to ensure that they remain prudent and affordable.

Moving from policy to practice

The devil is in the detail: the rules permitting enhanced dividends have been in place since 2012, but not all investment trust companies have changed their articles of association (for which shareholder approval is required) to permit enhanced dividend payments. Meanwhile, some may have changed their articles of association, but may not yet have progressed to adoption of an enhanced dividend policy.

For income-seeking investors, this innovation in the trust space is timely – investing in cash, or directly in dividend paying shares, is not without drawbacks. Investing to achieve enhanced dividends could well represent an attractive alternative option.

Here at J.P. Morgan Asset Management, several of our investment trusts feature an enhanced dividend policy, including JPMorgan Asian Investment Trust plc, which invests in equities around the region (excluding Japan) and JPMorgan Global Growth and Income plc, a dual-strategy trust that does just what it says.

For investors, the key to achieving long-term returns and managing risk lies in selecting a provider with the ability to build a globally diversified portfolio. Drawing on the full research resources of J.P. Morgan Asset Management’s locally-based investment teams, our global equity managers scour markets for attractive opportunities, while spreading risks across a broad range of stocks and sectors.

Holding a spread of internationally diversified assets in a portfolio can not only reduce investment risks by balancing losses from one particular holding with profits from another, but also increases exposure to potential sources of return.

Our broad range of investment trusts covers every major market and are diversified across regions and sectors—from portfolios focused on the UK stock market to those making the most of our considerable emerging markets strengths, such as in China and Russia. They provide access to global investment capabilities that few other managers can match, helping investors build truly diversified portfolios for long-term growth.

In an investment world where capital growth is hard to find and the total return on cash and gilts is negative, investors will continue to strive for inflation-beating income by using investment trusts to tap into the power of enhanced dividends.

To find out more about our global investment capabilities visit jpmorgan.co.uk/explore

IMPORTANT INFORMATION

This is a promotional document and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all-inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you.

It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Both past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co and its affiliates worldwide. You should note that if you contact J.P. Morgan Asset Management by telephone those lines may be recorded and monitored for legal, security and training purposes. You should also take note that information and data from communications with you will be collected, stored and processed by J.P. Morgan Asset Management in accordance with the EMEA Privacy Policy which can be accessed through the following website www.jpmorgan.com/pages/privacy.

Investment is subject to documentation (Investor Disclosure Document, Key Features and Terms and Conditions), copies of which can be obtained free of charge from JPMorgan Asset Management Marketing Limited. Issued by JPMorgan Asset Management Marketing Limited which is authorized and regulated in the UK by the Financial Conduct Authority. Registered in England No: 288553. Registered address: 25 Bank St, Canary Wharf, London E14 5JP. c6dca180-3585-11e7-beed-005056960c63

Leave a Reply

You must be logged in to post a comment.