Aug

2018

Humbug: Investing for a rich retirement has a good week

DIY Investor

12 August 2018

Breaking my own rule about taking profits/cutting a loss last week has come and bitten my botty, albeit the damage is minimal.

I’ve taken the lesson on board and won’t be doing it again, next time there could be real damage. (think Fagin and HGM)

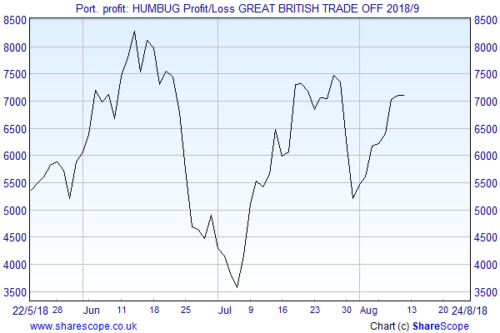

Great British Trade Off portfolio is up £1626 on the week.

Portfolio up 7.7% since April and once again not a million miles away from it’s all time high, I’m currently 64% invested.

One sale for the coming week (the one I should have done last week), one purchase on a top up signal and one full purchase signal I’m not going to touch with a pole.

I’ve said it before and will bet my life I’ll say it again before the end comes (unless the grim reaper has other plans for me and I don’t get to do many more postings).

I DON’T LIKE THIS VOLATILITY THE MARKETS ARE CURRENTLY SHOWING.

It makes striving for a steady but fairly rapid generation of capital gains by investing, from which I’m seeking to create financial independence with noughts on, something of a fraught experience right now.

A bit like the kids game of running full tilt up and down the escalators at a tube station. One minute everything is going up, the next going down.

As an investor, I understand and accept that I’m not driving the train.

But a nice smooth ride in the dining car with a first class ticket is the way I want to travel, not slumming it in cattle class without a ticket, never knowing if I’m going to be bounced out into the cold.

Looking to put a positive spin on it, and not wanting to tempt fate, my system of aggressive investing in funds using a traders eye to time entry and exit points is performing really well in what are dangerous and trying times.

Let’s hope it continues. Cross your fingers for me, my money is where my mouth is.

OK let’s look at what happened to me last week and my ‘cunning plan’ for the coming week.

My Great British Trade Off portfolio was up £1626 on the week and as you see from the graph, this week I’ve regained about 80% of last weeks losses. Also since April I’ve just about clawed back my losses from last year, at long last things appear to be moving in the right direction.

In this second year of the GBTO I’m just about level pegging Fagin in percentage terms, which I’m delighted about,

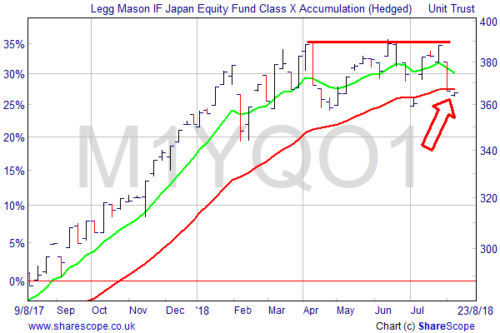

I sold out of the Legg Mason IF Japan Equity Fund.

It fell out of bed down below my red line (that doubles as a take profits/stop losses point) so it had to go. I’d hoped to only lose circa £210, but I suffered a little bit of slippage (as often happens) and lost £247 on what had been a £5k position.

I’d recently bought back in on a routine buying signal, but said at the time the fund needed to break up through 390 and that if it didn’t, all bets were off. It’s now failed three times to break out to new highs…………………….I’ll sit and watch it from the sidelines for a while.

£1626 up including taking a £247 hit……………………yeah a good week for me.

Going forward into my ‘cunning plan’ for the coming week, well to be honest it’s no big deal and not that cunning. All I’m planning to do is to work my system without hesitation, deviation or doing anything too stupid, hopefully.

One to sell, one to buy and one to pass on:

The sell is my £1k position in the Marlborough UK Micro-Cap Growth Fund that I should have sold last week, but didn’t.

COS I WAS COCKY AND OVER RODE THE SYSTEM, DUH.

This one is almost certainly going to bite my botty by costing me money. Not a lot of money, but in this world it’s always easier to lose money than it is to make it.

Had I done what my system tells me to do I’d have made (with hindsight) rather more than I first thought, my guess is about £50/55 which was not going to make me rich, but is fifty quid or so better than than I now expect.

This little saga is all a bit Micky Mouse as the sums involved are tiny, but the principle is what I need to take on board.

I’VE GOT A GREAT SYSTEM THAT BACK TESTS WELL AND IS PERFORMING NICELY IN THE CURRENT MARKET CONDITIONS. I BELIEVE IF I FOLLOW IT TO THE LETTER I WILL HAVE AN EDGE, SO WHAT’S NOT LIKE ABOUT OPERATING IT CORRECTLY.

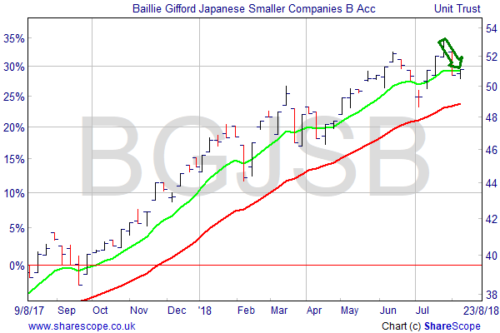

The buy; although I’ve just had to sell one of my Japanese holdings, my other has made a top up signal.

My Great British Trade Off portfolio was up £1626 on the week and as you see from the graph, this week I’ve regained about 80% of last weeks losses. Also since April I’ve just about clawed back my losses from last year, at long last things appear to be moving in the right direction.

In this second year of the GBTO I’m just about level pegging Fagin in percentage terms, which I’m delighted about,

I sold out of the Legg Mason IF Japan Equity Fund.

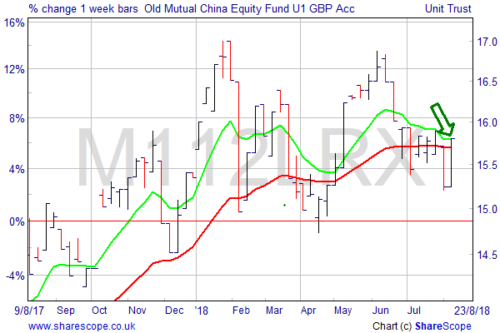

This has made a full buying signal, having come up through both the red and green lines. Now for richer or poorer I just don’t fancy the trade. The price in contrast to the Japanese fund that was on rails, is just all over the bloody place. NAH, I don’t want to risk my money on this (and I have discretion on whether to take a buying signal, but as I’ve explained, not a selling signal) so, I’m going to pass on it.

I’ll keep half an eye on it and will keep you posted. It’ll be interesting to see if my pessimism is justified.

Right there we have it. I hope you make money in the coming week and I hope I do as well. A nice steady £500 or so would be nice.

Brokers Commentary » Brokers Latest » Commentary » Equities » Equities Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.