Feb

2019

Housing crisis: Millennials set to be ‘generation rent’

DIY Investor

28 February 2019

A report by think tank The Resolution Foundation has found that up to a third of millennials face living in private rented accommodation all their lives; 40% of those born between 1980 and 1996 are living in rented housing when they hit 30.

The Foundation’s Home Improvements report said that this figure is double that of ‘generation X’ – those born between 1965 and 1980 – and that ‘generation rent’ needed much more help; it called for more affordable homes to be built for first-time buyers to be built, and better protection for renters.

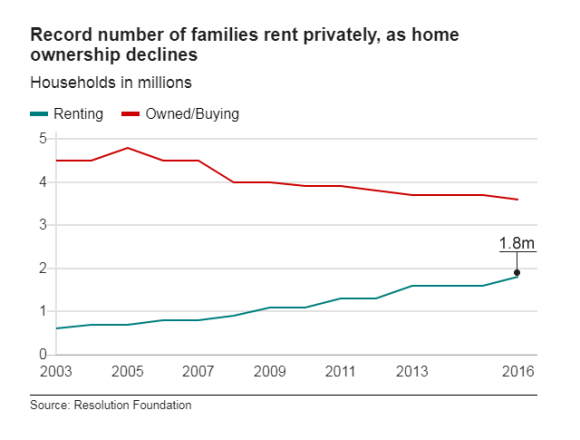

Revealing that a record 1.8 million families with children rent, up from 600,000 fifteen years ago, the report said that the private rented sector is often a reasonable choice for people with few ties, but that it is ‘far less fit for purpose’ for those with children because of the lack of security it provides.

Lindsay Judge of The Resolution Foundation, said: ‘Britain’s housing problems have developed into a full-blown crisis and young people are bearing the brunt – paying a record share of their income on housing in return for living in smaller, rented accommodation.

‘While there have been some steps recently to support housebuilding and first-time buyers, up to a third of millennials still face the prospect of renting from cradle to grave.

‘paying a record share of their income on housing in return for living in smaller, rented accommodation’

‘If we want to tackle Britain’s housing crisis we have to improve conditions for the millions of families living in private rented accommodation. That means raising standards and reducing the risks associating with renting through tenancy reform.’

The report adds that while housing benefit should be able to help millennial families, its value has been reduced relative to the previous generation. It calls for ‘light touch’ stabilisation policies to limit rent increases to the rate of inflation over a three-year period.

The report also says the tax system should be changed to discourage second home ownership, reducing stamp duty for people who own one home and increasing surcharges for second home owners.

As the numbers have increased – PWC predicts 7.2m households will rent by 2015, compared with 5.4m now and 2.3m in 2001 – the issue has become much more politically charged; the Labour Party has already proposed a cap on rent increases, along with three-year tenancies and a licensing scheme for landlords. It has also said it will build more council houses.

The Liberal Democrats are proposing a ‘rent-to-buy’ scheme to help renters purchase the homes they live in, as well as far more shared ownership and social housing.

Quoted on the BBC a spokesman for the Department of Housing, Communities and Local Government said: ‘Our Help to Buy scheme and the recent cut in stamp duty are helping more young first time buyers get on the property ladder. Figures show that we are seeing the highest number of first time buyers for more than a decade.

‘But we’re also … giving councils stronger powers to crack down on bad landlords and consulting on stronger protections for tenants themselves.’

Leave a Reply

You must be logged in to post a comment.