Sep

2020

From historical plaque to the cloud – fintech and the City

DIY Investor

5 September 2020

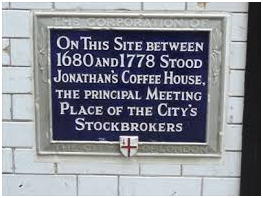

A tourist taking in the city  sights of Exchange Square and the Bank of England may easily miss a significant blue plaque in Change Alley. This historic plaque acknowledges the original home of stockbroking. Whereas today’s investment innovators sit in hubs and work in the cloud, it was all happening at Jonathan’s Coffee-House in the 18th century. So how does fintech (or financial technology) meet with old fashioned stockbroking?

sights of Exchange Square and the Bank of England may easily miss a significant blue plaque in Change Alley. This historic plaque acknowledges the original home of stockbroking. Whereas today’s investment innovators sit in hubs and work in the cloud, it was all happening at Jonathan’s Coffee-House in the 18th century. So how does fintech (or financial technology) meet with old fashioned stockbroking?

Having spent twenty years in traditional investment management and now leading a startup fintech business, it’s interesting to see how the old and the new work in parallel, overlap and compete. Here are a few views from both sides of the fence and the advantages for the today’s investors.

Technology has widened access to investments and brought costs to a fairer level for the consumer. This is positive for access but it also means sometimes investors can easily buy exotic and risky investments. One could argue such low barriers to purchase should be accompanied by a limited choice of the best assets – often open architecture or limitless choice are not always wise for the uninitiated buyer.

An uncelebrated but growing phenomenon in investments these days is ‘fractional ownership’, where you effectively co-own an asset with other investors. The proliferation of robo-advisers, property crowdfunders and the like allow for smaller and smaller minimum investment levels for consumers, and a diversified basket of such assets is to be celebrated. Fractional ownership means accessibility.

Imagine you want to dine at the top table in a restaurant, but you have to book the entire table before said aloof establishment will consider accepting your reservation. However, through a special operator you can buy a seat at that table alongside other like-minded diners, without the prohibitive expense of taking all the seats. This is a good way to think of fractional ownership, where you co-invest with other people – to access the inaccessible.

‘Co-investing’ is easy with some asset classes, but more difficult where they are the preserve of the financial elite or mega wealthy, as it’s more of a closed market. The operation of some investment markets, like corporate bonds, can make it feel like the top table in an auspicious manor house, where you may even need to know the right people to get the key to get in as well. Many fintechs operate to democratise such inaccessible markets.

Fintech firms have the benefit of being able to start with blank operating models. They are able to use the latest technology, unencumbered with legacy systems of the past. To build from fresh is dramatically easier than a migration exercise for an existing operator.

‘technology has widened access to investments and brought costs to a fairer level’

They also benefit from shorter, lithe, development cycles to test, learn and change new services with focus groups and then rollout to the investor community at speed with the latest solutions. Incremental development and change seems to be more the standard in fintech. Service standards are continuously nudged upwards step by step rather than in massive leaps.

Traditional operators have the benefit of being established businesses, with positive cashflows and masses of clients to see trends and develop them. Big business often requires big change too and the commercial risks in an established business rather than an emerging business are different; this has a large impact on culture, behaviour and eventual success.

The emergence of the “innovation centre” using personnel from an established business alongside people from startup back-ground can be a great melting pot. The change in fintech mindsets to ‘steal the pie’ has changed in the past 18 months to a more collaborative approach with established operators.

It’s interesting to speak to product development executives in established firms and see their roadmaps for the coming 24 months. Many are very similar with projects on new products where there are already many on the market. Some roadmaps simply have compliance and regulatory projects on them given the scale of rule changes in the pipeline. Others are missing gaps and that is where fintechs can steal a march. We’ve seen a gap and we’re working to fill it at speed.

Lawrie Chandler is the founder of bondsmart a new platform to bring fractional ownership to everyday investors that need income.

Leave a Reply

You must be logged in to post a comment.