Aug

2018

Financial independence: Humbug sits tight, loses money; Fagin breaks his own rule, loses even more

DIY Investor

6 August 2018

Humbug and Fagin’s search for financial independence continues in The Great British Trade Off 2018

Dignity, and even holiness too, sometimes, are more questions of coat and waistcoat than some people imagine. ~ Charles Dickens

Coat nor Waistcoat can spare my dignity in the way I have handled this saga of a botched trade in Highland Gold Mining (HGM)

If you have been following this trade in Humbug and Fagin’s Great British Trade Off, you will know that while Humbug has looked on with morbid curiosity, I Fagin, committed a week ago to exit the gold miner after already holding on too long.

After being a couple of grand down with it, I had the opportunity to get out at a loss of -£372. I became what is known in the US trading community as ‘a di*k for a tick’, got greedy for breakeven and then lost money with it again this week. It’s now -£2439 or minus two times my risk, doh!

It’s a strange thing but the only material money I have ever lost is when I break my own rules, otherwise it’s just the loss of any ‘businessman’s risk’ -£350 here, a loss of £600 there…. Anyhoo, I have a new target for exiting HGM this week. There was a small trigger again on Friday, so I have set my exit target at 134p in stone.

I have been quite lucky this week that despite more short-term volatility, my trades in Cairn Energy (CNE) and EVR Holdings (EVR) have pretty much held their ground through last Thursday’s pull back. I have also added IQE (IQE) and Games Workshop (GAW).

In addition to HGM, I also lost a third of my tiny position in KAZ Minerals (KAZ). So in total this week I am down net -£2601.98 including trading costs for new trades and stamp duty. So pretty much my HGM trade dragging me down.

Here is my homework for tonight (and every night):

- Determine plan of action on existing positions

- Determine trading mode (physically/mentally)

- Determine primary trends (which direction following)

- Look at personal basket of stocks (PBS)

- Look at strategy scans

- Determine trade plans

- Set up conditional orders or alerts

- Double check for input, earnings etc

Are you trading or investing to win your financial freedom like us?

Millions of people make money from the stock market every year. Some people promise you can get rich quick. Stock market investors claim you can live on the income from excellent shares. Some shrewd investors and traders have made millions in their ISA alone.

It can be hard to know where to start. What will make you more money? Trading like George Soros or investing like Warren Buffett?

It was this question that lead us (Humbug and Fagin), with the blessing of DIY Investor to undertake The Great British Trade Off, to see, using tour own money just which discipline will win in the search for wealth and financial freedom?

Yours, Fagin

Humbug’s taking it easy but loses value on each of his holdings in the recent ‘correction’

Headlines

- Naughty, I broke my rule about taking profits/stopping losses, seem to have got away with it, best I don’t do it again.

- It’s not been a fun week, my GBTO portfolio is down £2062.

- Only one trade for the coming week. Selling Japan for a loss of circa £210.

- Portfolio up 5.9% since the start of the 2nd year of the GBTO.

I’ve only got one selling order to place with my brokers, other than that there’s nothing for me to do to the Great British Trade Off portfolio this coming week; so I plan lots of siestas to get me through the very hot weather that’s forecast.

Let’s start this week’s report by looking back. Last week I reported that my tiny position in the Marlborough UK Micro-Cap Growth Fund had crashed and burned. I was supposed to sell and take a circa £27 profit out of my £1k holding.

It had gone down through my ‘take profit/stop loss’ which is a six week moving average but immediately bounced straight back up.

So I didn’t place the selling order. Naughty huh. I’m not supposed to do this sort of thing, the system is the system. This time it’s worked out OK so far and the monies involved are tiny…………………………………….but if I start making a habit of this I’ll cock the whole thing up. So best I don’t.

This week has not been a fun week to be honest. Corrections are a very necessary part of market activity and have a tendency to be rather steeper than the preceding gain, although hopefully only retracing (say) two thirds of the gain. This week’s correction has wiped £2062 off my profits for this current year and has been quite savage.

The question is, does today’s worldwide market rally mark the pivot point or will the decline continue next week? I have no idea, the charts I base all my investment decisions on follow the action, they don’t lead it.

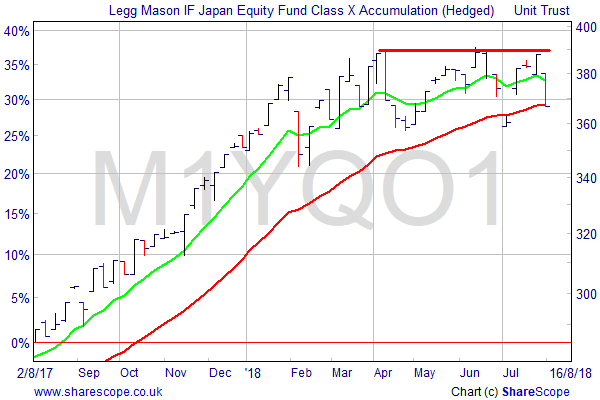

All of the eleven funds I currently hold are down this week, all bar one are in safe territory, but the Legg Mason IF Japan Equity Fund is down a fraction below the six week moving average.

So it has to go. Shame, I only bought back in three weeks ago, but as you can see the chart has changed. The strong uptrend from this time last year has been replaced by a fairly volatile sideways movement since March. It’s now failed three times to break out through 390p.

I bought it in the expectation that it would break out convincingly, it didn’t, so it’s game over as the stop has been hit.

My likely loss is circa £210 on a £5k position. All part of that ‘game’, last time I sold out of this fund I made £650.

The Japanese market in general and this fund in particular, have a lot going for them, I’ll bet my life, sometime in the future I’ll be buying in again.

That’s it for this week, going forward into next week, nothing to buy and just this one sale.

Leave a Reply

You must be logged in to post a comment.