Sep

2016

BATS CHALLENGES FTSE100 MONOPOLY & REDEFINES THE MARKET

DIY Investor

26 September 2016

Bats Europe, the region’s largest stock exchange operator has launched a series of UK-focused benchmark indices that will revolutionise investors’ view of the market, improve transparency and drive down costs; after 32 years FTSE has some serious and credible competition.

Bats Europe is a division of the Kansas City-based Bats Global Markets exchange group, and it has developed the indices in consultation with ‘incredibly frustrated’ investors and index users to deliver a ‘robust and trustworthy’ alternative to the incumbent.

Bats aims to break FTSE’s monopoly of the market by delivering ‘aggressively’ priced indices ‘with a long term commitment to materially reducing costs for all investors’.

With the industry committed to transparency post-RDR and increasingly focussed on reducing costs at a time of low investment returns, FTSE angered many in 2012/13 when it hiked the cost of data licences and reduced flexibility for licensees.

The ire generated is palpable in a CityWire headline that appeared at the time: ‘FTSE Licence Hike Fury: What are the Alternatives?’ Another described wealth managers as ‘seething’.

After numerous requests from investors and index users, Bats designed an alternative in consultation with the industry and its commitment to reduce costs has struck a chord with wealth managers, retail stockbrokers, media channels and investors alike; ultimately, higher data fees percolate through to the investor, creating a headwind for investment performance which is completely counter intuitive to those seeking to drive down costs and democratise investing.

‘a long term commitment to materially reducing costs for all investors’

Mark Hemsley, chief executive of Bats Europe, said that the launch was driven by retail brokers who were dissatisfied with the existing indices; ‘The cost of accessing index data is rising, and so they’re unhappy about that,’ he said. ‘The nature of the licenses is that they have become too expensive, more complex and intrusive.’

However, not satisfied by merely being cheaper than FTSE, aided by its unique position as the largest pan-European stock exchange, Bats has completely shaken up the market to the benefit of brokers and retail investors alike.

Key benefits of the new indices are that they:

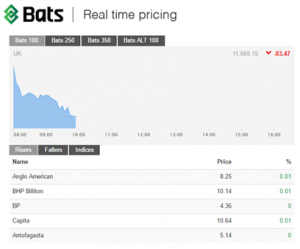

- Are published in real time, rather than with a fifteen minute delay

- All have a base value of 10,000 as of 31 December 2010, a ‘unique detail that ensures the performance of markets and sectors is easy to compare’

- Have simplified licensing arrangements that extend rights through licensees’ organisations, clients and partners with long-term commitment to materially reduce costs

- Are highly correlated with comparable benchmarks to accurately reflect market moves

When DIY Investor announced the launch of Bats’ 18 new UK indices covering large and small cap securities and 12 different sectors (Bats to the Future – DIY Investor 14th June) it also confirmed that it would be an early adopter, delivering real time pricing data to its users.

Bats’ flagship index is the Bats UK 100 or ‘BUK100’, an index of London-listed blue-chips that will go head to head with the London Stock Exchange owned FTSE 100.

The Bats initiative comes at a time when index investing is becoming increasingly popular with retail investors; Hargreaves Lansdown recently included thirteen low cost tracker funds in its influential Wealth 150 list and said that the proportion of its clients investing in trackers had doubled in the last five years.

Holly Mackay, of Boring Money, said the inclusion of passive funds was a ‘positive step’ because the best buy list was ‘a hugely influential funnel for DIY investors’ fund selections’

Fund managers ‘had found there had been a significant rise in the cost and complexity of pricing,’ said Mark Hemsley, CEO of Bats Europe. ‘You’ve got an incredibly frustrated user base just looking for competition.’

Most index providers license the indices for a fee to asset managers and brokers; in a move that revolutionises data provision, Bats’ new indices are free of charge for individual investor distribution, media firms and for benchmarking purposes.

‘the level of our pricing is aggressive, the commercial structures with brokers and fund managers are flexible and simplified’

They have been developed with the help of wealth management firms and retail brokers, including Alliance Trust Savings, Charles Stanley Direct, Hargreaves Lansdown, Barclays, Rathbones, Selftrade, AJ Bell and TD Direct Investing, which between them control more than £160 billion of client assets.

Sara Wilson, head of platform proposition at Alliance Trust Savings said ‘The launch of the new indices is extremely positive news for the industry, giving investors the chance to access real-time stock market information from a respected source,’

A key feature of Bats’ proposition is that its new indices are available in real-time unlike commonly-used indices whose values are often delayed by 15 minutes.

Those using a platform with fifteen minute delayed prices are shown an indicative price and then receive a live quote when their order is responded to by the retail service providers (RSPs) – the market makers; providing Bats index data delivers a major benefit by serving up live prices.

Bats CEO Mark Hemsley said the indices would bring choice and competition to a market that had become inefficient, expensive and lacked innovation to the point where customers had demanded change.

‘15 minutes is an enormous amount of time in financial markets,’ he said. ‘You can look to see where your taxi is in real time, and yet the average retail investor can’t see the direction of the market in real time.’

‘By giving investors an accurate, immediate view of precisely where the market is moving, we can help them make better informed trading and investment decisions. We’ve sought to make markets better, and more cost-efficient, for investors and traders – a first and very important step in improving index provision in Europe.’

Another key benefit is that because each of the indices has a base value of 10,000, allowing comparable benchmarks across sectors, between large and small cap, and as other indices are introduced, markets and regions.

Bats began in 2005 as an alternative trading venue aimed at bringing competition and innovation to the U.S. equities market; it launched in Europe in 2008 and became a Recognised Investment Exchange in May 2013. Approximately 24% of the value traded in European stocks each day is traded on Bats by professional traders at some of the world’s largest banks and brokers. Bats competes strongly for market share with world-class technology, products and services, delivering competition to monopoly style market structures.

All of the Bats Indices are calculated using data based on the trading taking place on its exchange with the exception of the Bats UK Alternative 100 which uses ISDX data; in addition to these 18 UK indices there are plans to launch benchmark alternatives to commonly used European indices in late 2016.

‘The level of our pricing is aggressive, the commercial structures with brokers and fund managers are flexible and simplified, the data is real time and that is great for their customers and their own usage,’ Mr Hemsley said about the launch.

Indices are a particularly attractive business for exchanges, and they offer the possibility of having exchange-traded funds (ETF) built from a particular index, such as an ETF based on the BUK100, for example.

Bats has won significant business from New York Stock Exchange and Nasdaq to become the number one listing venue for exchange-traded funds in the US and when asked about an ETF based on the UK indices Mr Hemsley said ‘We would definitely like to see that. We have already put that into the licensing structure, and the pricing structure.’

‘we can help them make better informed trading and investment decisions’

Bats’ entry into areas where FTSE is a strong brand such as the large-cap arena, could mean some funds switching benchmarks (witness the WMA’s recently announced switch from FTSE Russell to MSCI), or could see the creation of a new crop of products based upon the new indices and delivering more choice to the investor.

Quoted in FT Adviser, Gavin Hayes, managing director of Whitechurch Securities said: ‘I welcome competition in the market, with Bats looking to undercut the high charges that FTSE imposes on institutions quoting its indices and in providing real-time pricing to all investors free of charge through media outlets.’

Paul Chavasse, head of investment at wealth manager and fund house Rathbones, said an extra provider should benefit end-investors given the potential for stale products in a one-company situation: ‘Bats is providing a comprehensive, robust and low-cost set of real-time indices to end investors. This will offer more depth to the market for data provision, giving clients the information they need to help build and monitor their portfolios better.’

‘The current crop of bond and portfolio indices are not always what clients need. [Bats Europe’s launches] could stimulate examination of products to get better [products] for clients. If Bats did not enter the market now then I am not convinced [innovation] would have come.’

There is no denying the challenge that Bats faces given the pre-eminence that FTSE has enjoyed over three decades.

However, its launch is in response to a very real demand from a disgruntled user base and its solution is an innovative one that brings benefits to all market participants and in particular to its lifeblood – the DIY investor.

In the next issue we will be looking at the ways in which Bats indices are being deployed and get the reaction from brokers, media partners and asset managers.

Visit http://www.indices.batstrading.co.uk for real-time data and more information including the rules, methodology and FAQs.

Leave a Reply

You must be logged in to post a comment.