Dec

2018

A tale of two sisters and successful wealth creation

DIY Investor

16 December 2018

When the Nobel Prize-winning scientist Albert Einstein was asked to identify the most powerful force in the universe, he is said to have replied: “compound interest”.

It’s no joke to say that the mathematical phenomenon of compounding – or the ability for gains to grow on gains and income to arise from income – provides a powerful tool for anyone seeking to accumulate wealth. However, you will need time to make it work.

Whether you are saving up for a deposit to buy a home or to build a fund for retirement, the sooner you start the better. Like doing a little homework regularly over a long period, instead of waiting to start until the night before exams, this will make it easier to achieve your objectives.

‘a powerful tool for anyone seeking to accumulate wealth’

Better still, it’s easy to get started because many investment trust managers will accept regular investments from as little as £50 per month, which is less than many people spend on beer or coffee.

Investment trusts are pooled funds that enable individual investors to diminish the risk inherent in stock market investment by diversification; that is, spreading their money over dozens of different shares and other assets. The principle is the same as not having too many eggs in one basket. These trusts also enable individual investors to share the cost of professional fund management or stock selection.

J.P. Morgan Asset Management is one of the biggest UK managers of investment trusts, giving investors a choice of over 20 trusts, focused on different types of companies and countries around the world.

We will look at some trusts whose priority is capital growth later but, first, let’s consider how compounding can help investors build wealth. Here’s a personal finance parable, a tale of twin sisters Prudence and Extravaganza, to illustrate the value of saving sooner rather than later.

Prudence invests £100 a month from age 18 to 38 and then stops saving altogether. She achieves an average of 5% annual growth for the 20 years she invests and her fund continues to grow at 5% for the next 27 years until she retires at 65.

Extravaganza fritters away her money on frocks and handbags, saving nothing until she is 38. Then she starts saving £100 a month — until she, too, is 65. Extravaganza also achieves 5% a year during the 27 years she is investing.

‘Prudence has more than twice as much at retirement as Extravaganza’

At 18, both had nothing. When Prudence reaches 38 she has pension savings of £41,000. Extravaganza has zilch. Now, here’s the point of the tale: at age 65 Prudence has £145,795. Extravaganza has just £68,219.

So Prudence has more than twice as much at retirement as Extravaganza, even though Prudence invested a total of only £24,000, while Extravaganza invested £32,400.

The explanation is that Prudence invested for 20 years before Extravaganza got going and those early pounds had another 27 years to fructify or grow in the wise sister’s fund.

Which raises the question of which fund to choose. While the past is not a guide to the future and you may get back less than you invest on the stock market, it is worth considering what individual funds’ objectives are and how well they have performed in attempting to achieve them.

Options Further Afield

JP Morgan US Smaller Companies Investment Trust Plc

This trust seeks capital growth by investing in American businesses that have a sustainable competitive advantage. It also aims to focus on owning equity stakes in firms that trade at a discount to their intrinsic value.

How did that work out in practice? JPMorgan US Smaller Companies Investment Trust plc delivered a share price total return of 27% over the last 12 months. More importantly for medium to long-term investors, this trust also delivered share price total returns of 134% over the last five years.

Fund manager, Don San Jose, has been at the helm of this trust since 2008 and his co-managers Dan Percella and John Brachle joined in 2014 and 2017 respectively.

JPMorgan European Smaller Companies Trust plc

This trust aims to provide capital growth from smaller Continental companies. Its share price total return over the last 12 months has been more modest, at 4%, but its five-year return is 112%. Fund manager Francesco Conte has run this trust since 1998 and co-manager Edward Greaves joined him in 2016.

Options closer to home

JPMorgan Mid Cap Investment Trust plc

This tryst seeks capital growth from medium-sized companies listed in the United Kingdom. This trust delivered total share price returns of 8% over the last 12 months and 99% over the last five years.

Fund manager Georgina Brittain has led the way since 2012 and co-manager Katen Patel joined her in 2014.

The Mercantile Investment Trust plc

This trust seeks capital growth through a diversified portfolio of UK medium-sized and smaller companies. This trust delivered share price returns of 8% over the last 12 months, and 76% over five years. Martin Hudson has been at the helm since 1994 and was joined by co-managers Anthony Lynch in 2009 and Guy Anderson in 2012.

All the above performance statistics assume dividends were reinvested. Past performance is not a guide to the future and nobody is able to go back in time to invest at prices that prevailed five or 10 years ago.

However, the sooner you start investing the sooner you will get time and compound interest on your side. It’s not rocket science, is it?

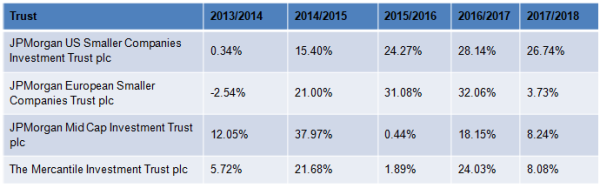

Share price quarterly rolling 12 month performance as at 30/09/2018

Share price performance figures are calculated on a mid market basis in GBP with income reinvested on the exdividend date. Performance source: J.P. Morgan Asset Management as at 30 September 2018. Past performance is not a reliable indicator of current and future performance.

This is a marketing communication and as such the views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader.

Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose.

The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results.

There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy.

IInvestment is subject to documentation (Investment Disclosure Document, Key Features and Terms and Conditions), copies of which can be obtained free of charge from JPMorgan Asset Management (UK) Limited.

This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. 0903c02a823f23aa

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.