Dec

2018

A Period of turmoil or transformation for retail?

DIY Investor

9 December 2018

Retailers have had a tough time from tipsters in 2018; might that be about to change asks James Bowden

Retailers have had a tough time from tipsters in 2018; might that be about to change asks James Bowden

The struggling retail sector has proven to be a successful hunting ground for bearish professional tipsters so far this year. Shares of retailers tipped as ‘Sell’ and ‘Avoid’ by tipsters have subsequently fallen over 13% on average, compared to a fall of almost 10% in shares given similar ratings by brokers.

Of course, since British Home Stores (BHS) stores closed across the country two years ago, there has been a sense of inevitability that bricks-and-mortar retailers would urgently need to engage in some internal reflection to survive.

While there have been some success stories, it’s been a turbulent year so far for many big high-street names – perhaps none more so than beleaguered fashion retailer Debenhams (DEB), discussed later.

Of course, various factors have come into play through the year which have caused subsequent swings in tipster confidence in the sector. First, winter brought heavy snow and freezing temperatures, before a scorching summer and much needed feel-good events such as the World Cup and Royal Wedding offered some respite for retailers.

But slowing consumer spending, falling wage growth and increasing competition from online behemoths such as Amazon have hit retailers hard.

A recent study by Deloitte suggests almost as many store closures in the first six months of 2018 than the whole of 2017. But tough conditions give rise to transformation and ingenuity in a sector that has perhaps rested on its laurels for too long, and recent retailer restructuring plans have been received positively, spurring tipster sentiment to some degree.

Good news?

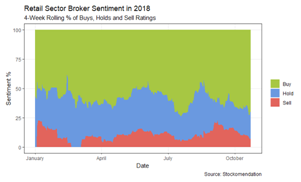

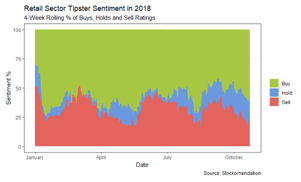

At a sectoral level both brokers and tipsters seem to be growing more positive about the prospects for UK retail. Exactly 70% of broker notes in October have offered ‘Buy’ ratings to retailers which – other than short stint at the end of July – is the highest level seen in 2018 so far. The same applied to Tipsters: the level of ‘Sell’ ratings stood below 20% late in October – the first time this has happened since May.

Due to the nature of their operations, brokers naturally offer a greater proportion of ‘buy’ ratings than independent tipsters. That’s why, in the chart above, the percentage of sell ratings in the sector is considerably higher for tipsters than brokers.

However, the retail sector is typically one of the key sectors where such a distinct divergence in sentiment exists, and it’s therefore unusual to find a company where brokers and tipsters agree unanimously. Sadly for Debenhams (DEB), the firm has done a very good job of uniting both tipsters and brokers in their ‘Sell’ consensus.

Tipsters Downbeat on Debenhams

A recently announced plan to close as much as fifty Debenhams stores in recent days has prompted a positive response of +12% in the firm’s shares, but let’s put this in perspective: shares are languishing over 70% below their levels at the end of 2017, and the firm expects ‘no improvement in the trading environment for the foreseeable future’.

Action was urgently required, and it has now – finally – been taken. But for professional tipsters and brokers alike, it’s a case of too little, too late. Motley Fool contributor Roland Head believes that the business will survive, but adds that ‘it’s likely to need an injection of fresh cash at some point. This could be highly dilutive for shareholders, so I’d avoid this stock for now’.

Debenhams (DEB) Share Price and Tipster Sentiment (2016 – 2018)

Edward Sheldon (also the Motley Fool) also suggests that investors should ‘steer well clear’, and brokers such as Goldman Sachs, Peel Hunt, Deutsche Bank, Numis and Liberum Capital have awarded the company a ‘hold’ or ‘sell’ in recent weeks. Meanwhile, with a total declared short position of 11% taken against shares in the retailer, Debenhams continues to be amongst the most shorted stocks on the London Stock Exchange.

With all that being said, Roland Head sees signs of hope, with the new-format stores outperforming the more traditional outlets and online sales growth of 16% for the second half of the year. Given the current consensus outlook, going long in Debenhams shares isn’t for the faint-hearted.

Not all doom and gloom

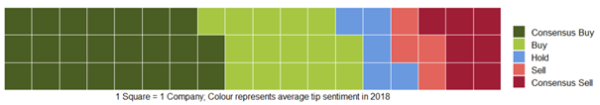

Debenhams typifies the problems faced by the sector, but it is something of an extreme. The chart below shows average broker and tipster sentiment towards 54 retailers, and shows that 38 of these firms had a positive average rating.

Some of these only marginally squeezed into the ‘Buy’ category; Pets at Home Group (PETS) for example has received 33 tips so far this year, with an average score of 3.1 (where ‘Buy’ = a score of 5 and ‘Sell’ = a score of 1), while Next marginally achieves ‘Buy’ status (56 tips, average score = 3.2).

Other retailers have unanimously strong positive sentiment.

Of these, Shoe Zone (SHOE) received the most tips (14 tips, average score = 5.0). The firm recently announced an update announcing that full-year profit would beat market expectations, and tipsters such as Tom Winnifrith (ShareProphets), Roland Head (The Motley Fool) and Rupert Hargreaves (The Motley Fool) have been keen on the shares for some time. B&M European (BME) (39 tips, average score = 4.95) remains something of a darling amongst brokers and tipsters alike. Tipster Royston Wild notes that ‘in times of constrained consumer spending like these, this strive to deliver exceptional value [will] keep driving profits at B&M higher’.

On the other side of the spectrum, online shopping site Koovs (KOOV) has been recipient of a stream of negative ratings (6 tips, average score = 1.00). Shares have slumped over 35% since the beginning of the year, and tipsters Gary Newman and Steve Moore of ShareProphets have been particularly scathing in recent months, with the former ‘struggling to see how the business model works’. Other big names such as Mothercare (9 tips, average score = 2.33) and Marks & Spencer Group (41 tips, average score = 2.76) reside firmly in ‘Sell’ territory.

What’s in store?

There is no doubt that retailer woes are far from over, but tough conditions have enforced much-needed change and transformation, such as tilting towards providing more of an ‘experience’ to consumers than a simple shopping trip.

The number of buy ratings awarded by tipsters and brokers in the sector is testament to this. Furthermore, Deloitte suggest that the picture is not quite as gloomy as the media often depicts; stores are not closing simply due to trading conditions, but due to a ‘tipping point’ in changing consumer behaviour.

Therefore, keeping an eye on the sector, and being able to pick out those retailers that are ahead of the curve can yield strong results for investors. Keeping an eye on what financial commentators are saying can prove to be a useful tool in a rapidly changing industry, and that’s what we try to offer out users at Stockomendation.

Click logo to visit

Disclaimer: The contents of this article should not be considered financial advice. Returns used in this analysis are expressed as price returns. All information displayed as at 26th October 2018.

Leave a Reply

You must be logged in to post a comment.